BALTIMORE (Stockpickr) -- "If you want to become a millionaire, start off as a billionaire and buy an airline." So goes the conventional wisdom of airline investing.

And for years, that advice has been dead on the money; airline stocks have done a good job of enriching bankruptcy attorneys and few others. In fact, it's difficult to even look at historical airline stock performance in the last decade or two simply because so many have gone out of business. So yes, the conventional wisdom says you'd have to be nuts to own airline stocks.

But as I'm about to show you, the conventional wisdom is wrong this time.

Why Investors Hate Airlines

Airlines are one of the go-to examples when people talk about cyclical industries. Cyclical doesn't mean straight down, though. Instead, it means that after every painful long-term correction, there's some exuberance to be had. And right now, we're entering "buy mode."

So why do investors hate airlines in the first place?

To be sure, there are some big headwinds in the airline business. First, it's capital-intense. New jets cost a fortune, so there are some big fixed costs that need to get vaulted before an airline can book its first penny of profit. Ongoing maintenance isn't cheap either. The safety record for U.S. air carriers is stellar for good reason: The FAA requires airlines to maintain their planes, pilots and crew to a high standard.

Variable costs aren't much better. Far and away, the biggest variable cost for air carriers is fuel. And with the upward trajectory of crude prices for the last few decades, it's no wonder that airlines have struggled to stay profitable. But fuel costs aren't a one-way street.

Instead, airlines have three big weapons they can use against the climbing cost of crude: hedging, fuel efficiency and rate hikes. While hedging has lost favor with many carriers (because it's hard to do right and easy to do wrong), more efficient aircraft and rising airfares have been working hard to boost margins at airlines.

Both of those fixes are slow. Higher efficiency means cutting huge checks for new planes, and airfare increases risk ceding market share to rivals. But both have made a material difference in airline profitability in the last few years.

Industry Changes Are Afoot

Another key trend that's pumping profits into airlines has been industry consolidation. In the last few years we've seen Delta Air Lines (DAL) swallow up Northwest, United and Continental merge together to form United Continental (UAL), and Southwest (LUV) buy AirTran, in addition to scores more lower-profile combinations of every shape and size.

A proposed merger between American Airlines parent AMR (AMR) and US Airways Group (LCC) is the latest big-legacy combination to hit the headlines.

Industry consolidations cut costs, they improve efficiency, and they improve airlines' pricing power on their most lucrative routes.

The industry shakeups have been dramatic enough that you don't even need to crack a 10-K filing to see that's true. Instead, just ask a frequent flier with elite status whether it's gotten easier or harder to snag those complimentary upgrades on their trips. Flight occupancy has reached a record-high 80.3% this year, according to IATA.

Today, the planes are more full, and less profitable routes have been eliminated. The end result is bigger profits for airlines. And that's putting record industry revenue within reach for 2014.

A Solid Technical Time to Buy Airline Stocks

Ultimately, none of that fundamental improvement matters if the market doesn't notice it.

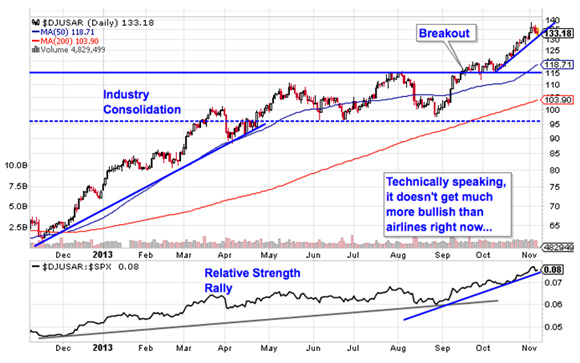

But airline stocks have been on fire this year, stomping what's already been a strong year for the S&P 500. From a technical standpoint, the Dow Jones U.S. Airlines Index looks well-positioned for more upside even following a nearly 85% rally year-to-date:

Airlines spent some time consolidating sideways this summer, bleeding off some overbought momentum after a fast start to the year. But the industry broke out again in the middle of September, and it's just now starting to find its legs again.

Looking at the index from a relative strength basis, we're actually seeing even stronger outperformance over the S&P this quarter than we saw to start the year. That's a very strong signal that now's the time to be a buyer.

So, with all that in mind, which airline stocks make sense to buy?

For starters, individual stocks are your only choice. As of this year, there aren't any more exchange-traded funds that track airline stocks. But I think that just two names offer the best of all worlds in the airline industry right now.

Delta Air Lines

Believe it or not, old-school legacy carrier Delta is the best-in-breed airline stock right now. Delta is one of the country's oldest carriers and one of the largest airlines in the world, with more than 720 aircraft serving 247 mainline destinations globally. And it makes sense to own Delta if only for the stellar execution this company has churned out in recent years.

Delta's margins have become huge. The firm was able to drive 13% of every sales dollar directly down to its bottom line in the most-recent quarter. Even if that feat can't be sustained indefinitely, it's a promising accomplishment nevertheless. Delta's balance sheet leverage is manageable, especially considering nearly $4 billion in cash that the firm currently holds in its coffers.

One of the most compelling things about Delta is that despite its legacy reputation, the firm is actually one of the most diversified names in the airline business. Besides its regular brand, Delta owns a stake in Virgin Atlantic, and it operates a private jet charter business. As revenues climb in 2014, Delta's operational prowess should help it reward its investors the most.

Southwest Airlines

One corner of the market that Delta has yet to crack successfully is discount air travel. The firm's Song brand landed for the last time in 2006, reverting back to mainline Delta livery in an effort to cut costs. Southwest Airlines is still the best low-cost carrier play more than four decades after pioneering the model.

Southwest's point-to-point network to nearly 100 destinations eschews the hub and spoke approach seen at legacy carriers. As a result, consumers looking for direct flights at non-hub locations get considerable convenience by booking with LUV. The firm was also the first to roll out a single-aircraft model across an entire fleet, dramatically reducing maintenance costs and keeping customer experience uniform.

Now, as LUV adds on new, more lucrative routes such as Hawaii, Cabo and Cancun, shareholders stand to benefit. Southwest has historically been one of the most effective fuel cost hedgers as well, something that reduces a lot of commodity risk when it's done right. While there's no shortage of publicly traded low-cost carriers out there, LUV is the one to own.

-- Written by Jonas Elmerraji in Baltimore.

No comments:

Post a Comment