Most of us are old enough to remember when pizza and Chinese food were the only cuisines you could easily get delivered, but now, if a restaurant isn't associated with one of the rising delivery platforms, it's behind the curve. From small, single-location shops to giant chains, the food is coming to where you are. But can the service providers -- and investors -- profit?

In this segment from MarketFoolery, host Chris Hill and analyst Abi Malin dig into the food delivery space, considering the majors: GrubHub (NYSE:GRUB), with its $7.2 billion market cap, and the only pure play that's public; DoorDash, valued at $7.1 billion, but still privately held; Postmates, which will IPO soon and is valued at around $1.85 billion; and of course, Uber Eats, part of the ridesharing empire that is also headed for an IPO. Is this a game of winner takes most, or is there room for a lot of winners? And what are the differences between the various players' strategies?

A full transcript follows the video.

This video was recorded on March 5, 2019.

Chris Hill: I wanted to talk to you about the food delivery space because you're the first person at this company I ever remember hearing talking in a meaningful way about Grubhub as a stock and saying, "No, really, this is one worth paying attention to." And Grubhub the stock has had kind of a rough 12 months, but in general, this is a well-run business, and if you're a long-term shareholder, you've been rewarded because of that. Where do you think this space is right now? Obviously, with Grubhub competing against the likes of DoorDash, which is private for now, Postmates, which announced they're going public, and any number of regional players --

Abi Malin: Uber.

Hill: Uber, with Uber Eats, that sort of thing. This seems like maybe not a mature market, but a maturing market. What do you see when you look at this landscape?

Malin: I think it's a really interesting space. For a little bit of context, Grubhub is about a $7.2 billion market cap. As you mentioned, in February, Postmates has filed initial paperwork for an IPO. They're valued at about $1.85 billion. Still smaller, but again, still a unicorn, up with those other ones that are waiting for public offerings. Then, you have DoorDash, which announced another round of funding at the end of February. They're put at about a $7.1 billion valuation, almost equivalent with Grubhub. Then you have Uber Eats, which is obviously factored into Uber's overall valuation.

It's definitely a spot where investors are seeing opportunity. I think it's an interesting spot, again, because Grubhub is really the only pure play that is public, where you have the most information. I still would say it's pretty early on in these stages. When Grubhub first came public, I don't think people saw this as an opportunistic space. I think we're now turning the corner on that, and we're not sure who this winner is going to be, or if it's one winner or all of these are winners. But finally feels like people are recognizing this space.

Hill: What caught my attention the other day was a TV commercial for DoorDash. For the longest time, people of my age and older just thought in terms of, "If I'm going to get something delivered to my house, I have to call the restaurant if I'm looking for anything other than pizza." Now, you have Grubhub, Uber Eats, DoorDash, all these others come along, and they say, essentially, "Whatever restaurant you want, we're going to get it for you." The DoorDash commercial, I thought, did a great job of getting that across. It was showing in the commercial a variety of different people in different situations, different life situations. A young couple with a newborn baby, people throwing a party, all this stuff. All these different situations and all these different cuisines, and it was essentially, "Yeah, DoorDash is going to get you there." And for whatever reason, for me, who has not used any of these services, it was a little bit of a light bulb moment. I was just like, "Oh, that's how this works! I just get the DoorDash app on my phone, and presumably, I don't have to worry about what I'm in the mood for."

Towards that end, and you just touched on this, I'm not saying this seems like a zero-sum game, but it really does strike me as an industry right now that's only going to have a couple of winners. It's hard for me to imagine, if they do it, right, that Grubhub or DoorDash -- or Uber Eats for that matter; I'm sorry, Postmates, but the name alone just isn't getting me interested, so I'm just going to push them off. But it's hard for me to imagine that if they execute on the right level, that they don't become one of two or three winners.

Malin: Everyone is trying to carve out their niche. Recently, you've seen Grubhub push out with a lot of chain national brands. Postmates, I know you dismiss them --

Hill: I'm dismissing the name, that's all. DoorDash, I get it, right from the name. Postmates, I immediately go to post-it notes.

Malin: Postmates is a little bit of a different operating strategy. They deliver random items. They have a partnership with Apple and Walgreens as well as restaurant food. They do unlimited delivery subscriptions for deliveries of $15 or more for a flat fee of $9.99 per month. In that sense, I would think Postmates is more of an Amazon competitor, which is not a space I'd be as interested in.

Hill: [laughs] The fact that they're saying, "We're going to start a business, and we think we'd like to replace Amazon in terms of delivery."

Malin: Yeah, that's challenging. I mean, a flat fee for delivery is kind of interesting, but I don't know about the logistics of doing all of the other tech and medicine and things like that. DoorDash, they've also started delivering groceries. They partnered with Walmart last year.

Logistics is a hard business. There's never going to be a huge amount of profit, it's going to constantly be a game of small margins. Originally, when I started looking at this space, I thought, at least on a geographic basis, there's going to be one dominant player, so it's going to be a winner-take-all, at least by geography. Maybe my thinking has shifted a little bit. If you look at other logistics industries -- ridesharing, you have Uber, Lyft, traditional Yellow Cab, and a lot of regional or geographically focused players. Housing, so, you have Airbnb vs. Marriott vs. Hyatt, etc. Package and parcel delivery, you have the U.S. government, in addition to Amazon's own logistics, in addition to UPS and FedEx and all these other players. Maybe there is room for more than one, is my new thinking. But I haven't decided where that caps out. On some level, it can't just be price, right? We have to have some other differentiator that makes one more or less appealing.

Hill: Right. To that point, it all comes down to the execution. You can love Grubhub until they start doing a bad job of delivering, then you have other options. Who do you use?

Malin: I use Grubhub. Grubhub owns Seamless and I first started ordering delivery when I was using Seamless in New York.

Hill: Definitely an interesting space that we're going to keep watching. Curious to see how these IPOs go.

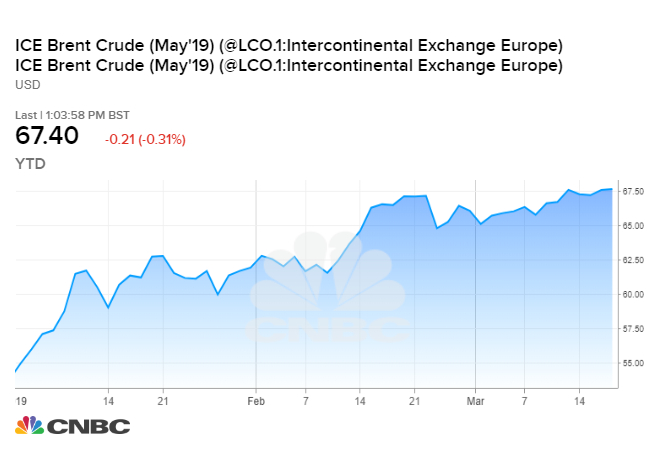

Helima Croft on the oil rally 6:50 AM ET Mon, 18 March 2019 | 03:58

Helima Croft on the oil rally 6:50 AM ET Mon, 18 March 2019 | 03:58  Watch CNBC's exclusive interview with Mike Pompeo and Rick Perry 8:40 PM ET Tue, 12 March 2019 | 09:23

Watch CNBC's exclusive interview with Mike Pompeo and Rick Perry 8:40 PM ET Tue, 12 March 2019 | 09:23

Shares of Cyclacel Pharmaceuticals Inc (NASDAQ:CYCC) shot up 7.5% during trading on Friday . The stock traded as high as $0.90 and last traded at $0.86. 1,753,743 shares traded hands during mid-day trading, an increase of 258% from the average session volume of 489,758 shares. The stock had previously closed at $0.80.

Shares of Cyclacel Pharmaceuticals Inc (NASDAQ:CYCC) shot up 7.5% during trading on Friday . The stock traded as high as $0.90 and last traded at $0.86. 1,753,743 shares traded hands during mid-day trading, an increase of 258% from the average session volume of 489,758 shares. The stock had previously closed at $0.80. Triangles (CURRENCY:TRI) traded flat against the US dollar during the 1-day period ending at 20:00 PM Eastern on March 14th. Triangles has a market cap of $68,409.00 and $0.00 worth of Triangles was traded on exchanges in the last day. In the last week, Triangles has traded flat against the US dollar. One Triangles coin can currently be purchased for about $0.53 or 0.00014299 BTC on exchanges.

Triangles (CURRENCY:TRI) traded flat against the US dollar during the 1-day period ending at 20:00 PM Eastern on March 14th. Triangles has a market cap of $68,409.00 and $0.00 worth of Triangles was traded on exchanges in the last day. In the last week, Triangles has traded flat against the US dollar. One Triangles coin can currently be purchased for about $0.53 or 0.00014299 BTC on exchanges.  Shares of BioSig Technologies Inc (NASDAQ:BSGM) have earned an average broker rating score of 1.00 (Strong Buy) from the one brokers that provide coverage for the stock, Zacks Investment Research reports. One equities research analyst has rated the stock with a strong buy rating.

Shares of BioSig Technologies Inc (NASDAQ:BSGM) have earned an average broker rating score of 1.00 (Strong Buy) from the one brokers that provide coverage for the stock, Zacks Investment Research reports. One equities research analyst has rated the stock with a strong buy rating.  Mid-America Apartment Communities Inc (NYSE:MAA) EVP Robert J. Delpriore sold 215 shares of Mid-America Apartment Communities stock in a transaction that occurred on Tuesday, March 12th. The stock was sold at an average price of $107.04, for a total transaction of $23,013.60. Following the completion of the sale, the executive vice president now owns 30,903 shares of the company’s stock, valued at $3,307,857.12. The transaction was disclosed in a document filed with the SEC, which can be accessed through this link.

Mid-America Apartment Communities Inc (NYSE:MAA) EVP Robert J. Delpriore sold 215 shares of Mid-America Apartment Communities stock in a transaction that occurred on Tuesday, March 12th. The stock was sold at an average price of $107.04, for a total transaction of $23,013.60. Following the completion of the sale, the executive vice president now owns 30,903 shares of the company’s stock, valued at $3,307,857.12. The transaction was disclosed in a document filed with the SEC, which can be accessed through this link.

Zacks Investment Research cut shares of SVMK (NASDAQ:SVMK) from a hold rating to a sell rating in a research note published on Saturday morning.

Zacks Investment Research cut shares of SVMK (NASDAQ:SVMK) from a hold rating to a sell rating in a research note published on Saturday morning.

Michael A. Robinson

Michael A. Robinson Stewart Information Services Corp (NYSE:STC) declared a quarterly dividend on Monday, March 4th, Wall Street Journal reports. Stockholders of record on Friday, March 15th will be paid a dividend of 0.30 per share by the insurance provider on Friday, March 29th. This represents a $1.20 annualized dividend and a dividend yield of 2.80%. The ex-dividend date is Thursday, March 14th.

Stewart Information Services Corp (NYSE:STC) declared a quarterly dividend on Monday, March 4th, Wall Street Journal reports. Stockholders of record on Friday, March 15th will be paid a dividend of 0.30 per share by the insurance provider on Friday, March 29th. This represents a $1.20 annualized dividend and a dividend yield of 2.80%. The ex-dividend date is Thursday, March 14th.