Small cap apparel and accessories retailer The Jones Group Inc (NYSE: JNY) has been rising on speculation of a buyout, but the stock has also underperformed the both the SPDR S&P Retail ETF (NYSEARCA: XRT) and the Dow over the longer haul. Nevertheless, the buyout speculation does make the stock worthy of a closer look.

What is the�Jones Group?

The Jones Group a leading small cap global designer, marketer and wholesaler of over 35 brands with product expertise in apparel, footwear, jeanswear, jewelry and handbags which are marketed�directly to consumers through branded specialty retail and outlet stores, through concessions at upscale department stores and through its e-commerce sites. The Company's internationally recognized brands and licensing agreements (L) would include: Nine West, Jones New York, Anne Klein, Kurt Geiger, Rachel Roy (L), Robert Rodriguez, Robbi & Nikki, Stuart Weitzman, Brian Atwood (L), Boutique 9, Easy Spirit, Carvela, Gloria Vanderbilt, l.e.i., Bandolino, Enzo Angiolini, Nine & Co., GLO, Joan & David, Miss KG, Kasper, Energie, Evan-Picone, Le Suit, Mootsies Tootsies, Grane, Erika, Napier, Jessica Simpson (L), Givenchy (L), Judith Jack, Albert Nipon, Pappagallo and Rafe (L).�

5 Best Small Cap Stocks To Watch For 2014: OCZ Technology Group Inc(OCZ)

OCZ Technology Group, Inc. designs, develops, manufactures, and distributes computer components for computing devices and systems worldwide. It primarily offers solid state drives, flash memory storage, memory modules, thermal management solutions, AC/DC switching power supply units, and computer gaming solutions. The company?s products are used in industrial equipment and computer systems; computer and computer gaming solutions; mission critical servers and high end workstations; personal computer (PC) upgrades to extend the useable life of existing PCs; high performance computing and scientific computing; video and music editing; home theatre PCs and digital home convergence products; and digital photography and digital image manipulation computers. OCZ Technology Group, Inc. offers its products to retailers, on-line retailers, original equipment manufacturers, systems integrators, and distributors. The company was founded in 2002 and is headquartered in San Jose, Califo rnia.

Advisors' Opinion: 5 Best Small Cap Stocks To Watch For 2014: InterDigital Inc.(IDCC)

Interdigital, Inc. engages in the design and development of digital wireless technology solutions. The company offers technology solutions for use in digital cellular and wireless products and networks, including 2G, 3G, 4G, and IEEE 802-related products and networks. It holds patents related to the fundamental technologies that enable wireless communications. The company licenses its patents to equipment producers that manufacture, use, and sell digital cellular and IEEE 802-related products; and licenses or sells mobile broadband modem solutions, including modem IP, know-how, and reference platforms to mobile device manufacturers, semiconductor companies, and other equipment producers that manufacture, use, and sell digital cellular products. InterDigital?s solutions are incorporated in various products comprising mobile devices, such as cellular phones, tablets, notebook computers, and wireless personal digital assistants; wireless infrastructure equipment, such as base stations; and components, dongles, and modules for wireless devices. The company was founded in 1972 and is headquartered in King of Prussia, Pennsylvania.

Advisors' Opinion: - [By CRWE]

InterDigital, Inc. (NASDAQ:IDCC) reported that certain of its subsidiaries have completed the previously announced sale of roughly 1,700 patents and patent applications to Intel Corporation for $375 million in cash.

- [By Evan Niu, CFA]

What: Shares of InterDigital (NASDAQ: IDCC ) have gotten crushed today by as much as 20% after the company lost a patent suit against several smartphone makers.

EZchip, a fabless semiconductor company, engages in the development and marketing of Ethernet network processors for networking equipment. Its products include network processor chips, evaluation boards and network-processor based systems, and development software toolkits. The company offers network processors for use in forming the silicon core of networking equipment, such as switches and routers; and for voice, video and data integration in various applications. Its network processors are single-chip solutions, which enable its customers to design multi-port line cards, such as processing and classification engines, traffic managers, media access controllers, as well as a range of specialized hardware blocks that accelerate various functions. The company offers Evaluation systems which enable customers to test NPU-based systems; and toolkits that assist customers in creating, verifying, and implementing solutions based on its network processors. It provides a library f eaturing data plane code for a range of applications, which include Metro Ethernet protocols, Multi-Protocol Label Switching, IPv4 and IPv6 routing, Access Control Lists, GPON/EPON OLT functionality, Network Address Translation, and Server Load Balancing. The company sells its products directly, and through contract manufacturers and distributors to network equipment vendors. It markets its products in Israel, China, Hong Kong, the Far East, Canada, the United States, and Europe. The company was formerly known as LanOptics Ltd. and changed its name to EZchip Semiconductor Ltd. in July 2008. EZchip Semiconductor Ltd. was founded in 1989 and is based in Yokneam, Israel.

Advisors' Opinion: - [By Jake L'Ecuyer]

EZchip Semiconductor (NASDAQ: EZCH) was also up, gaining 7.16 percent to $24.11 after a Cisco (NASDAQ: CSCO) announced a new product that would not threaten the company as previously thought. Equities Trading DOWN

Shares of Cypress Semiconductor (NASDAQ: CY) were down 16.05 percent to $9.91 after the company lowered its Q3 forecast.

- [By Paul McWilliams]

Paul McWilliams: Oh, absolutely. Another company that most investors probably have never heard of is a tiny little Israeli semiconductor company named EZChip (EZCH).

- [By Lisa Levin]

EZchip Semiconductor (NASDAQ: EZCH) shares climbed 5.80% to $23.53. The volume of EZchip Semiconductor shares traded was 635% higher than normal. EZchip Semiconductor's PEG ratio is 1.57.

- [By Evan Niu, CFA]

What: Shares of EZchip (NASDAQ: EZCH ) have jumped today by as much as 13% after the company reported first-quarter earnings.

So what: Revenue in the first quarter totaled $15.3 million, topping the Street's forecast of $15.1 million. Non-GAAP net income per share came in at $0.23, which was right on target with expectations.

5 Best Small Cap Stocks To Watch For 2014: ATA Inc.(ATAI)

ATA Inc., through its subsidiaries, provides computer-based testing services in the People?s Republic of China. It offers services for the creation and delivery of computer-based tests utilizing its test delivery platform, proprietary testing technologies, and testing services; and provides logistical support services relating to test administration. The company?s computer-based testing services are used for professional licensure and certification tests in various industries, including information technology (IT) services, banking, securities, teaching, and insurance. Its e-testing platform integrates various aspects of the test delivery process for computer-based tests ranging from test form compilation to test scoring, and results analysis. ATA also provides career-oriented educational services, such as single course programs, degree major course programs, and pre-occupational training programs focusing on preparing students to pass IT and other vocational certification tests; test preparation and training programs and services to test candidates preparing to take professional certification tests in securities, futures, banking, insurance and teaching industries; online test preparation and training platform for the securities and banking industries; and test preparation software for the teaching industry. In addition, the company offers HR select employee assessment solution, an online system that utilizes its proprietary software and an inventory of test titles to help employers improve the efficiency and accuracy of their employee recruitment process. As of March 31, 2010, it had contractual relationships with 1,988 ATA authorized test centers. The company serves Chinese governmental agencies, professional associations, IT vendors, and Chinese educational institutions, as well as individual test preparation services. ATA Inc. was founded in 1999 and is based in Beijing, the People?s Republic of China.

5 Best Small Cap Stocks To Watch For 2014: FuelCell Energy Inc.(FCEL)

FuelCell Energy, Inc., together with its subsidiaries, engages in the development, manufacturing, and sale of high temperature fuel cells for clean electric power generation primarily in South Korea, the United States, Germany, Canada, and Japan. The company offers proprietary carbonate Direct FuelCell Power Plants that electrochemically produce electricity from hydrocarbon fuels, such as natural gas and biogas. Its fuel cells operate on a range of hydrocarbon fuels, including natural gas, renewable biogas, propane, methanol, coal gas, and coal mine methane. The company also develops carbonate fuel cells, planar solid oxide fuel cell technology, and other fuel cell technologies. It provides its products to universities; manufacturers; mission critical institutions, such as correction facilities and government installations; hotels; and natural gas letdown stations, as well as to customers who use renewable biogas for fuel, including municipal water treatment facilities, br eweries, and food processors. The company was founded in 1969 and is headquartered in Danbury, Connecticut.

Advisors' Opinion: - [By Bryan Murphy]

Had shares of its peers and competitors performed as well, it may not even be worth bringing up. But, Plug Power Inc. (NASDAQ:PLUG) shares have done significantly better than FuelCell Energy Inc. (NASDAQ:FCEL) and Ballard Power Systems Inc. (NASDAQ:BLDP) since the end of March. And, PLUG has performed considerably better than FCEL and BLDP have since mid-August. This is more than "just a little volatility." This is a leader breaking away from the pack after a very long lull. Thing is, there's plenty more room for Plug Power to keep running.

- [By Green Energy Addict]

On June 3, 2013 I gave my 5 Bullish Signs ahead of the FuelCell Energy (FCEL) Q2 2013 earnings report. I cited the large backlog as one of the reasons for my bullish views. I gave as my reasoning the following:

) released its third quarter earnings results on Thursday after the closing bell, posting earnings that beat analyst expectations, while revenues missed.

) released its third quarter earnings results on Thursday after the closing bell, posting earnings that beat analyst expectations, while revenues missed.

Despite all the political turmoil over health care and persistent Republican efforts to defund the Affordable Care Act, health care has been a top-performing sector in the mutual fund universe.

Despite all the political turmoil over health care and persistent Republican efforts to defund the Affordable Care Act, health care has been a top-performing sector in the mutual fund universe.

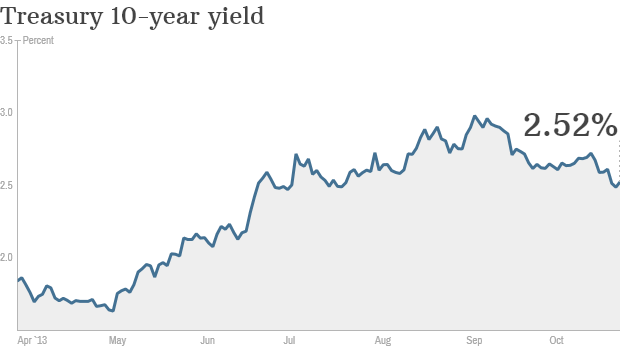

Why there isn't a bond bubble

Why there isn't a bond bubble

There are two clues that point to that outcome here. One of them is the fact that even though SolarCity Corp. has been running hard for nearly a couple of weeks now, the buying volume has been drifting lower that whole time. It's going to need growing participation rather than fading participation if the strength is going to keep chugging.

There are two clues that point to that outcome here. One of them is the fact that even though SolarCity Corp. has been running hard for nearly a couple of weeks now, the buying volume has been drifting lower that whole time. It's going to need growing participation rather than fading participation if the strength is going to keep chugging.

Hosted by Marketfy

Hosted by Marketfy  Get Benzinga's News Delivered Free Zing Talk: Daily Top Stories

Get Benzinga's News Delivered Free Zing Talk: Daily Top Stories