BALTIMORE (Stockpickr) -- Every correction in this market rally is sending an important message to investors: Don't ignore the dividend stocks.

Even in bull markets, dividends are make-or-break for your portfolio. For instance, just year-to-date, dividends have actually contributed more to the total returns in the Dow Jones Industrial Average than capital gains have. And it's not just the stodgy Dow.

Must Read: Must-See Charts: Trade These Big Stocks for Big Gains

In fact, even among the faster-moving S&P 500, dividend-paying stocks have contributed nearly a third of total returns this year. Put simply, if you don't own dividend stocks in this market, you're getting owned performance-wise.

But to find the biggest benefit from dividends, it's not enough to simply buy names with big payouts today. You've got to think about what they'll be paying tomorrow, too. So instead of chasing yield, we'll try to step in front of the next round of stock payout hikes.

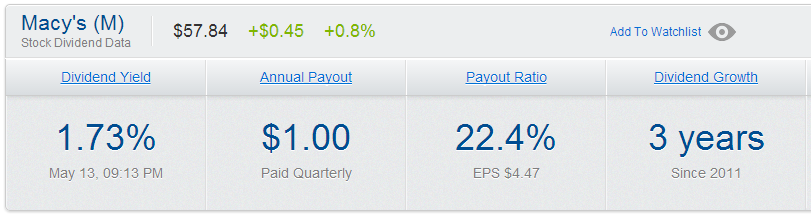

For our purposes, that "crystal ball" is composed of a few factors: namely a solid balance sheet, low payout ratio, and a history of dividend hikes. While those items don't guarantee dividend announcements in the next month or three, they do dramatically increase the odds that management will hike their cash payouts to shareholders. And they've helped us grab onto dividend hikes with a high success rate in the past.

Without further ado, here's a look at five stocks that could be about to increase their dividend payments in the next quarter.

Must Read: 4 Bargain Bin Stocks to Pad Your Portfolio

AT&T

First up is AT&T (T), the company that has the distinction of being the highest-yielding stock in the Dow -- and not by a little, either. AT&T pays out a 5.23% dividend yield at currently price levels, a huge payout considering the fact that we're in a record-low interest rate environment. For income investors, it's hard to ignore the draw of that big 46-cent quarterly payout. Thing is, it looks ready to get even bigger.

AT&T is the nation's second-largest wireless carrier, with more than 99 million customers. It's also one of the biggest landline operators in the country, with more than 27 million phone lines and 17 million internet users. With the pending acquisition of DirecTV (DTV), AT&T will dramatically boost its exposure to the pay-TV market, particularly in high-growth Latin America. Ultimately, more services from AT&T means more cross-selling opportunities from its huge customer Rolodex, and that should help drive margins higher in the years to come.

Financially speaking, AT&T looks cheap right now compared to the rich valuations found elsewhere in the market. Besides the hefty dividend yield, shares currently sport a trailing 12-month price-to-earnings ratio of 10, a whopping 52% discount to the rest of the telecom sector. Given the dropping payout ratio at AT&T since 2011, a dividend hike looks in order in the next quarter.

If history is any guide, look for a dividend boost announcement in early November.

Must Read: How to Trade the Market's Most-Active Stocks

CVS Health

Drugstore chain CVS Health (CVS) may not sport the huge payout seen at AT&T -- it currently pays a 27.5-cent dividend that adds up to a 1.4% yield -- but it's another name that's looking primed to boost its payout in the next quarter. CVS has undergone some big changes in recent months. For starters, it changed its name slightly, signaling a new focus on overall consumer health (and ending $2 billion in annual tobacco sales within its stores).

The shift should give extra credibility for CVS, which operates some 7,000 pharmacy locations across the U.S. as well as a pharmacy benefit manager that handles more than a billion prescriptions each year. That integrated drugstore and PBM operation cuts out the middleman and gives CVS access to fatter margins. CVS has been working to recreate that structure elsewhere (particularly in the Latin American market) posting a pending 5 billion real bid for Brazilian drugstore chain Drogarias Pacheco in May, and the acquisition of Miami's Navarro Discount Pharmacies in September.

CVS has some big demographic drivers for growth in the years ahead. An aging population is driving pharmaceutical volumes here at home, and that increased demand should help to fuel profits for CVS. The introduction of MinuteClinic health clinic locations at approximately 500 of CVS' retail locations is another important growth driver it gives customers a cheaper alternative to a doctor's office, and a big incentive to fill prescriptions in-house. Importantly, MinuteClinic also makes CVS completely vertically integrated, driving bigger profit margins.

With profitability climbing, CVS looks due to announce a dividend hike next quarter.

Must Read: Warren Buffett's Top 10 Dividend Stocks

Stryker

Stryker (SYK) is another health care name that looks ready to hike its dividend payouts in the coming quarter. Stryker designs and manufactures medical equipment and instruments ranging from hip and knee implants to operating room equipment. The firm is one of the biggest names in the orthopedic implant space, which should see increasing demand as the average age of the U.S. population increases. SYK still earns 65% of its revenues here at home.

Stryker has upped its exposure to other corners of the medical world in recent years, growing to become the leading provider of operating room equipment as well. That means that Stryker benefits from overall procedure volumes, not just from orthopedic procedures, which are elective and have some correlation to the economy.

Financially speaking, Stryker is in good shape. The firm currently carries $878 million in net cash (that is, cash less debt), a number that's significant because it means that the firm carries zero leverage on its balance sheet. Given the capital-intense nature of the medical device business, that's an important distinction. Right now, SYK pays out a 30.5-cent quarterly dividend that adds up to a 1.5% yield at current price levels, but investors should be on the lookout for a raise in the quarter ahead.

Must Read: 5 Stocks With Big Insider Buying

Aflac

Specialty insurance firm Aflac (AFL) continues to provide an attractive alternative to conventional life insurers -- and shares even look cheap in 2014. Aflac is one of the biggest supplemental insurers in the world, with a lucrative business in the U.S. and Japan. Even though insurance products are largely commoditized these days, Aflac's brand success gives it fatter margins than the norm. Last quarter, net margins came in at a very respectable 13.8%.

Aflac's policies are designed to pay out cash benefits if customers meet a predetermined condition -- normally contracting a disease or being involved in an accident. Because they're loss-of-income policies, Aflac has an easier sale in an environment where everyone remembers the Great Recession from several years ago. Likewise, since they're deducted directly from paychecks in many cases, there's no sticker shock effect from seeing money go out each month.

Japan is, by far, Aflac's biggest market, contributing around 80% of the firm's profits. Japanese Aflac customers are also extremely sticky -- the firm estimates that the average customer stays with Aflac for nearly 20 years. An aging population in Japan (much like here) is more cognizant of the fact that supplemental health or income coverage may be a good idea, and that continues to be a big driver for Aflac.

ALF's payout ratio has been in a steady decline in the last several years, which means that Aflac's dividend isn't keeping up with its income growth. With a payout ratio down around 20%, there's plenty of room for Aflac to boost its 37-cent payout in the next quarter.

Must Read: Buy These 5 Momentum Movers to Stomp the S&P

Williams-Sonoma

Last up is high-end housewares stock Williams-Sonoma (WSM), a name that's been a strong performer so far in 2014: at this point, WSM's 15.6% total return is nearly triple the performance of the S&P once dividends are factored in. A combination of growing luxury segment spending and well-run store chains is the driver for WSM's relative strength in the market right now.

At current levels, the firm pays out a 2% dividend yield.

Williams-Sonoma goes beyond its namesake kitchenware brand. In addition, it owns the Pottery Barn, West Elm, and Rejuvenation marquees, operating nearly 600 stores worldwide in total. As a brand-name housewares retailer, Williams-Sonoma captures thick margins, a trend that's been expanding as it leverages its own valuable brand to offer an increased share of private label merchandise to shoppers.

Likewise, the firm's financials look strong. Historically, WSM has avoided turning to debt to grow its store footprint (in fact, it's even opted to franchise stores in some foreign markets), and that means that its balance sheet is squeaky clean. That, in turn, clears the way for a boost to the firm's 33-cent quarterly dividend payout. Instead of paying lenders, WSM is free to pay shareholders. Investors should look out for the possibility of a dividend hike by the end of the year, just be cognizant of the fact that this stock's yield could drop as its price momentum carries shares higher.

Buying WSM here locks in the yield today.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>4 Stocks Under $10 Triggering Breakout Trades

>>5 Stocks Spiking on Unusual Volume

>>QE5 Is Coming -- and Here's How to Profit

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in the names mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.

Follow Jonas on Twitter @JonasElmerraji

Popular Posts: 7 Biotechnology Stocks to Buy Now5 Diversified Utilities Stocks to Buy Now17 Oil and Gas Stocks to Sell Now Recent Posts: 3 Mortgage Stocks to Buy Now 5 Media Stocks to Buy Now 5 Diversified Utilities Stocks to Buy Now View All Posts

Popular Posts: 7 Biotechnology Stocks to Buy Now5 Diversified Utilities Stocks to Buy Now17 Oil and Gas Stocks to Sell Now Recent Posts: 3 Mortgage Stocks to Buy Now 5 Media Stocks to Buy Now 5 Diversified Utilities Stocks to Buy Now View All Posts  REUTERS

REUTERS

In a telephone interview on June 20, during Schwab’s invitation-only Explore event for its RIAs in Tucson, Ariz., Bettinger (at left in photo) and Bernie Clark (right), who runs Schwab Advisor Services (SAS), spoke of the opportunities for RIAs and some initiatives that SAS was rolling out. However, Bettinger also spoke of some other topics dear to his heart, and reiterated that “advisors are core to our overall corporate strategy; they’re not a sideline business.” Advisors in Schwab Advisor Services, he said, “are our primary strategy in the high-net-worth” space.

In a telephone interview on June 20, during Schwab’s invitation-only Explore event for its RIAs in Tucson, Ariz., Bettinger (at left in photo) and Bernie Clark (right), who runs Schwab Advisor Services (SAS), spoke of the opportunities for RIAs and some initiatives that SAS was rolling out. However, Bettinger also spoke of some other topics dear to his heart, and reiterated that “advisors are core to our overall corporate strategy; they’re not a sideline business.” Advisors in Schwab Advisor Services, he said, “are our primary strategy in the high-net-worth” space.

Zuma Press

Zuma Press

) reported first quarter earnings that came in above analysts’ estimates. The company also announced a 25% dividend increase.

) reported first quarter earnings that came in above analysts’ estimates. The company also announced a 25% dividend increase.

A provocative chart demonstrating a sharp negative correlation between 10-year Treasuries and the dollar appears to suggest the U.S. currency may be losing its safe-haven appeal.

A provocative chart demonstrating a sharp negative correlation between 10-year Treasuries and the dollar appears to suggest the U.S. currency may be losing its safe-haven appeal. Bloomberg News

Bloomberg News