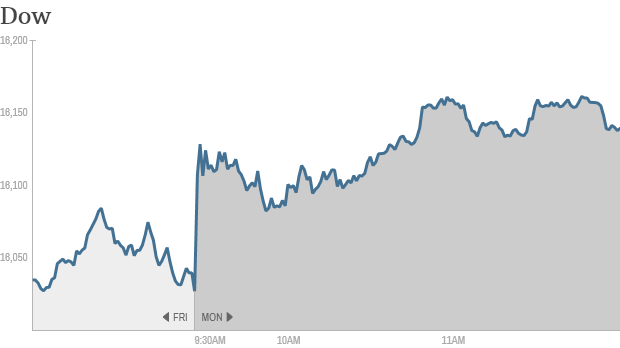

NEW YORK (CNNMoney) Investors came back and dusted themselves off after a stomach churning sell-off last week.

NEW YORK (CNNMoney) Investors came back and dusted themselves off after a stomach churning sell-off last week. The main driver of this newly found optimism is a better than expected report from Citigroup and strong retail sales data. The Nasdaq is up over 1% in midday trading, and the S&P 500 and Dow Industrials aren't far behind.

The star of the show today is Citigroup (C, Fortune 500). The third largest U.S. bank's stock has gained more than 4% after the company released first quarter earnings that beat analysts' forecasts. Profits rose 4% from the same period last year.

Earnings from Bank of America (BAC, Fortune 500), Goldman Sachs (GS, Fortune 500), and Morgan Stanley (MS, Fortune 500) will come later in the week.

One trader on StockTwits was skeptical of Citigroup's performance. JJSinghSTARR suggested that it had more to do with accounting than actual earnings,"$C For management... I'm not sure how smart it is to have these loan "write-ups" just after you failed a stress test. Counter intuitive?" Citigroup's capital plan failed a Federal Reserve stress test a few weeks ago.

MaxDamage echoed JJSinghSTARR,"$C Another day, another set of dodgy bank numbers. Look how they beat, and then you can see through the smoke and mirrors."

Much of the recent choppiness in the markets have been drive by so called "momentum stocks", the tech and biotech companies that had an incredible run in the past year, but have fallen sharply in recent days.

On Monday, tech stocks were on the rebound. Facebook (FB, Fortune 500), Twitter (TWTR), Amazon.com (AMZN, Fortune 500), Netflix (NFLX), Google (GOOG, Fortune 500) and Yahoo (YHOO, Fortune 500) were all gaining ground.

Traders expect more volatility as earnings season kicks into full swing over the next few weeks. Google and Yahoo will report earnings this week as well. It's interesting to note that CNNMoney's Fear & Greed Index is still solidly in "extreme fear" mode.

Another stock that took a pounding on Friday, but is bouncing back today is Herbalife (HLF). Shares of the multi-level marketer plunged after a report in the Financial Times saying the that the Department of Justice and the FBI had launched a criminal probe of the company. But Herbalife (HLF) said it had "no knowledge of any ongoing investiga! tion by the DOJ or the FBI."

OPTIONSPAIDFORMYS550 was pessimistic, "$HLF The REAL question here is how SOON before one of the government agencies mentioned in Friday's article confirms the investigation."

But there were plenty of Herbalife (HLF) defenders like KiddoTrader,"HLF Bulls, don't be intimidated by some Ackman puppets on this board... use your common sense." Hedge fund activist Bill Ackman is a vocal critic of the company and has a billion dollar bet that the stock will go to zero.

Snoooop40 is another Herbalife (HLF) fan, "You may be unsatisfied with existing laws regarding MLM's (multi-level marketers), but $HLF will be found to be operating legally. The MUTHA of all bear-traps. Gulp."

On the economic front, March retail sales posted their biggest gain since September 2012, up 1.1% as shoppers started returning to stores after the frigid winter months. Sales were exceptionally strong at auto dealers.

In deal news, the financial services company TIAA-CREF is buying Nuveen Investments for $6.25 billion including debt. Nuveen has $221 billion in assets under management and brings TIAA-CREF's total assets under management to $800 billion.

One of the biggest gainers in the S&P500 today is Edwards Lifesciences. (EW)That's because the company was granted a preliminary injunction limiting the sale of Medtronic's (MDT, Fortune 500) competing heart valve system. Medtronic is leading the list of S&P losers today.

European markets closed higher, but there was an air of caution regarding the growing threat of U.S. and European sanctions against Russia.

Russian stocks and the ruble dropped as the continuing strife between Russia and Ukraine ramped up to a fever pitch. Pro-Russian protesters seized a police station in Ukraine and the government threatened to oust them with a "full scale anti-terrorist operation."

"Even before this, the U.S. and Europe were threatening more sanctions as Russia forces! remain a! massed on the Ukraine border," wrote currency strategist Marc Chandler in a market report for Brown Brothers Harriman. "The position and weapons of those forces ... is leading NATO to conclude that Putin is seeking the full occupation of Ukraine."

Asian markets closed mixed. ![]()

No comments:

Post a Comment