Semiconductor maker Advanced Micro Devices (NYSE: AMD ) has been showing improved performance in the last few quarters. It was dominated by Intel (NASDAQ: INTC ) in the past, and the declining PC industry was not helping its cause. The company's ongoing recovery is spurred by the transition from conventional PCs to semi-customs, dense servers, and professional graphics. All of these markets allow for future growth and present AMD with an opportunity to capitalize.

Revenue and EPS

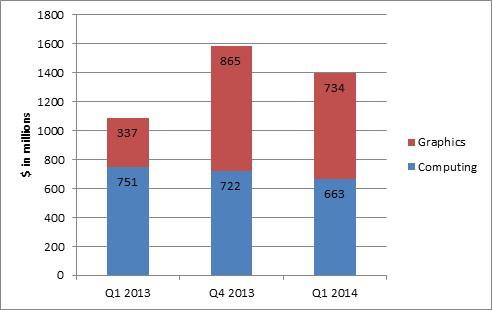

The company posted revenue of $1.40 billion this quarter, which translates to a 12% decrease sequentially and a 28% increase on a year-over-year basis. The year-over-year figure is more relevant, as the nature of AMD's business is cyclical.

Source: Earnings press release

Revenue increased due to the custom chip business, which grew in the wake of Sony PlayStation 4 and Microsoft Xbox One sales. Discrete graphics also grew, due to the increasing popularity of AMD's R7 and R9 graphics cards. However, revenue growth was capped by the declining computing segment, due to negative growth in the PC market. The diagram bellows shows the changing mix of AMD's revenue and its declining reliance on the PC industry:

Figures from CFO commentary

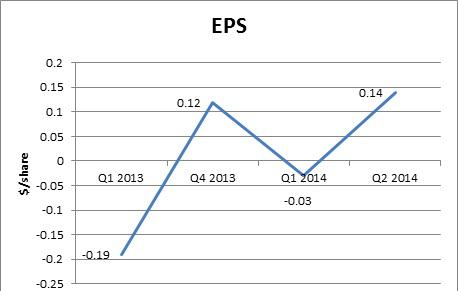

AMD posted a net loss of $20 million, as opposed to a loss of $146 million in the same quarter last year. We can see in the graph below that earnings per share improving -- apart from cyclical changes, the trend is an upward one.

Data from Yahoo! Finance, earnings report and estimates

The above argument for revenue growth also holds true for EPS. The operating income of the graphics business fell to $91 million, from $121 million in the previous quarter, due to the cyclical nature of custom SoCs and a slight increase in operating expenses. The company has managed its operating expenses, but they are expected to increase and remain at $450 million per quarter going forward.

Data from CFO commentary

Overall, the revenue and EPS position of the company is improving on a year-over-year basis thanks to semi-custom growth, increased ASP of GPUs, and lower operating expenses in the computing segment. The company will experience growth in the future, as Sony and Microsoft are expected to sell approximately 5 million and 4 million units of their respective consoles in 2014. ARM-based dense servers also hold promise for AMD beyond 2015.

Cash and balance sheet position

The cash and cash equivalent balance, including marketable securities, stands at $982 million, compared to $1.2 billion in the adjacent quarter. A payment of approximately $200 million to Global Foundries caused the decline in cash and cash equivalents. However, the current ratio stands at 1.94 ,and the interest cover is also above 1, indicating that the company does not face any short-term liquidity problems. AMD got its long-term financing in order recently by reprofiling its near-term debt maturities. Overall, AMD's balance sheet position is satisfactory and the risk of bankruptcy is remote.

Cash and cash equivalent trend

Valuation and final thoughts

The valuation is derived by taking management's 2014 guidance and making projections based on IDC and Gartner data, using free-cash-flow methodology. Revenue and net income is as follows:

Assumptions for FCF calculations:

Standard capital asset pricing model assumptions. Growth of 12% p.a. is assumed until 2018, based on IDC and Gartner sales projections. Growth of 4% is assumed in perpetuity. Capital expenditures are assumed to grow at a compound annual rate of 5%. It is assumed that the beta is correlated to the volatility of the business.

The price target reveals potential upside and is justified by AMD's strategy to focus on growth segments like custom SoCs and professional graphics. Note that the effect of dense servers is assumed to offset the PC decline, but barely. However, this is a prudent view, as dense servers will grow at a much faster pace amid cloud and data-center growth.

AMD is still transitioning away from its PC business. Its graphics segment is supporting the growing revenues, and the company is improving its quarterly performance. Consoles will continue to boost profits going forward. New design wins will further strengthen AMD's position. It seems to have a promising future.

3 stocks poised to be multi-baggers

The one sure way to get wealthy is to invest in a groundbreaking company that goes on to dominate a multibillion-dollar industry. Our analysts have found multi-bagger stocks time and again. And now they think they've done it again with three stock picks that they believe could generate the same type of phenomenal returns. They've revealed these picks in a new free report that you can download instantly by clicking here now.

No comments:

Post a Comment