MKM Partners recently released a bullish note on Alibaba (BABA) stock with a Street-high $280 price target, implying more than 40% upside from current levels. We largely agree with MKM's bull thesis on Alibaba, and further believe that near-term margin concerns are unnecessarily short-sighted, while big picture investors would be wise to focus on the company's accelerating top-line growth narrative.

Overall, we feel that BABA stock remains materially undervalued below $200. Given peer valuations and intrinsic earnings growth potential, we believe that BABA stock can easily rally to and above $230 this year, while also maintaining the view that prices above $250 are achievable.

BABA data by YCharts

BABA data by YCharts

As MKM Partners shrewdly points out, BABA stock has been held down recently by margin concerns. We highlighted this in our most recent article about Alibaba. In that article, we noted that the company is investing big into new-growth expansion markets (like global retail, AI, and cloud computing), and that these investments are weighing heavily on profits in the near-term. But such near-term investments are also powering an increasingly robust top-line growth narrative with improving longevity.

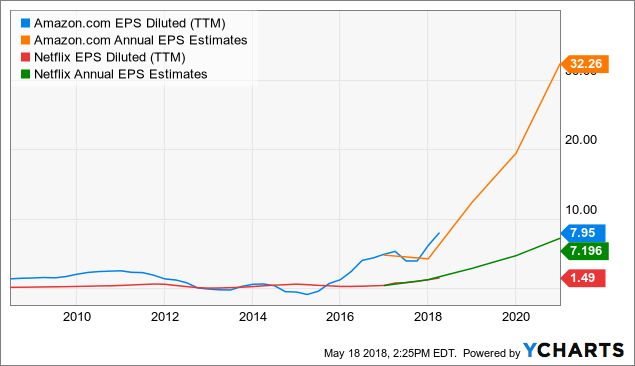

As such, we concluded that Alibaba was astutely following in the footsteps of Amazon (AMZN), Netflix (NFLX), and other hyper-growth tech giants. That means sacrificing near-term margins for long-term profit growth (investors would be wise to read this article, which astutely outlines that this strategy has somewhat become the norm today). Thus, the bear thesis centered around near-term margin compression seemed unnecessarily short-sighted to us. Eventually, growth-related investments will peel back, and margins will ramp up on a significantly larger revenue base. At that point in time, earnings will soar much like they have and will continue to do so at Amazon and Netflix.

AMZN EPS Diluted (NYSE:TTM) data by YCharts

AMZN EPS Diluted (NYSE:TTM) data by YCharts

Thus, the most important thing at Alibaba right now is revenue growth, because if revenue growth remains robust, then that means the company's big investments are paying off.

Fortunately, Alibaba's revenue growth not only remains robust, but is actually accelerating across the board. Total revenue growth last quarter was 61%, versus 56% the prior quarter and 60% in the year ago quarter. Core commerce revenue growth was 62% last quarter, versus 57% the prior quarter and 47% in the year ago quarter. Cloud computing growth was 103% last quarter, versus 104% last quarter and 103% in the year ago quarter. Digital media and entertainment growth was 34% last quarter, versus 33% the prior quarter (year ago quarter doesn't offer good comparable). Active consumer growth on the company's China commerce platforms was 22% last quarter, versus 16% last quarter and 7% in the year ago quarter.

Thus, across the board, Alibaba's revenue growth trajectory is actually improving. The only place it is slowing down is in Cloud Computing. That slow-down is by merely 1 percentage point and revenues are still more than doubling year-over-year. Everywhere else, from Core Commerce to Digital Media to user growth, Alibaba's growth rates are getting bigger.

That is a sure-fire sign that yesterday's big investments are yielding materially positive return, and turning into today's big growth. Because of this, we remain confident that, just as yesterday's big investments are fueling today's big growth, today's big investments will fuel tomorrow's big growth. That is why we are bullish on management's guide for revenues to grow in excess of 60% this year, versus 58% last year.

From this perspective, we aren't terribly concerned that near-term margins are in retreat. As stated earlier, eventually, Alibaba's commerce and cloud businesses will scale, management will peel back investments, margin growth will come back into the picture, and profits will head significantly higher in a hurry.

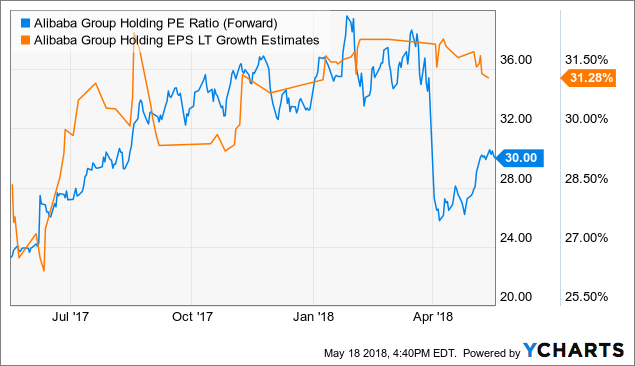

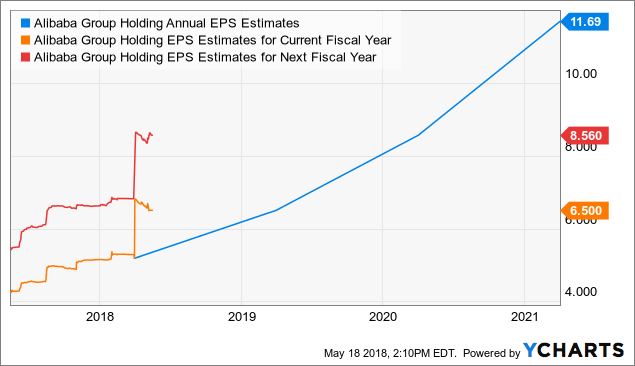

This positive long-term growth outlook is not priced into shares at current levels. Alibaba stock trades at just 30x forward earnings for what the Street sees at 30%-plus earnings growth over the next 5 years. That means that BABA stock sports a PEG (price-to-earnings/growth) ratio of under 1, while the stock market average PEG is 1. That makes no sense considering Alibaba's earnings growth is projected to be twice as big as the market's earnings growth (~30% versus ~15%).

BABA PE Ratio (Forward) data by YCharts

BABA PE Ratio (Forward) data by YCharts

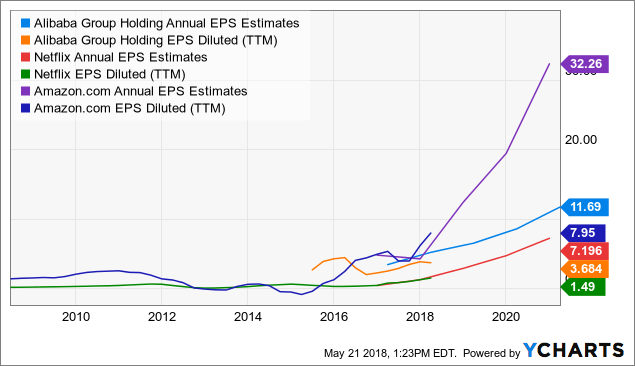

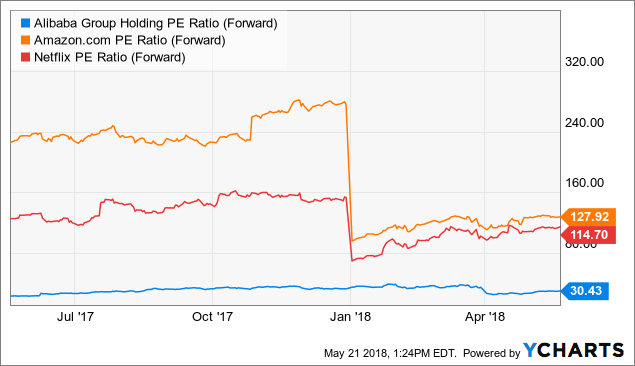

Moreover, Alibaba's earnings ramp over the next several years is expected to closely resemble Netflix and Amazon's earnings ramp over the next several years, as all three companies will benefit from the rewards of lower investment on a huge revenue base. Despite those similar growth trajectories, BABA stock trades at just 30-times forward earnings, versus triple digit multiples for NFLX and AMZN.

BABA Annual EPS Estimates data by YCharts

BABA Annual EPS Estimates data by YCharts BABA PE Ratio (Forward) data by YCharts

BABA PE Ratio (Forward) data by YCharts

Because of these valuation discrepancies, we feel that BABA stock could easily get to $230 by the end of the year, and further feel that $250-plus price targets for this year are reasonable.

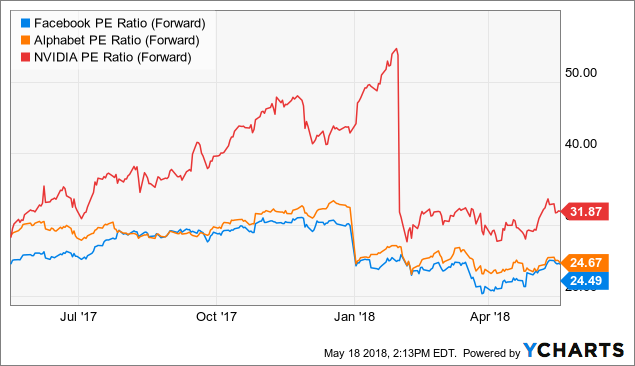

The market-average forward earnings multiple is 16. Growth stocks trade around 20-times forward earnings. The class of Facebook (FB), Alphabet (GOOG) (NASDAQ:GOOGL), and NVIDIA (NVDA) trade between 25- and 30-times forward earnings. Alibaba is growing revenue faster than the average stock, faster than the average growth stock, and faster than Facebook, NVIDIA, and Alphabet.

As such, we believe that BABA stock easily deserves a FB/NVDA/GOOG multiple in the 25-30 range. A 27.5-times forward multiple on next year's consensus earnings estimate of $8.56 implies a year-end price target of over $230.

We also realistically see BABA deserving a multiple north of 30, given its bigger revenue growth. In that scenario, BABA stock could reasonably trade north of $250 by the end of the year (30 multiple on $8.56).

BABA Annual EPS Estimates data by YCharts

BABA Annual EPS Estimates data by YCharts FB PE Ratio (Forward) data by YCharts

FB PE Ratio (Forward) data by YCharts BABA Revenue (Quarterly YoY Growth) data by YCharts

BABA Revenue (Quarterly YoY Growth) data by YCharts

Overall, we feel that Alibaba is a case of discounted valuation converging on a big growth company. That discounted valuation is the result of reasonable, but short-sighted, concerns related to near-term margin compression. Eventually, those concerns will blow over, and BABA's valuation will normalize. At that point in time, BABA stock will explode higher.

Disclosure: I am/we are long BABA, FB, GOOG, AMZN.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment