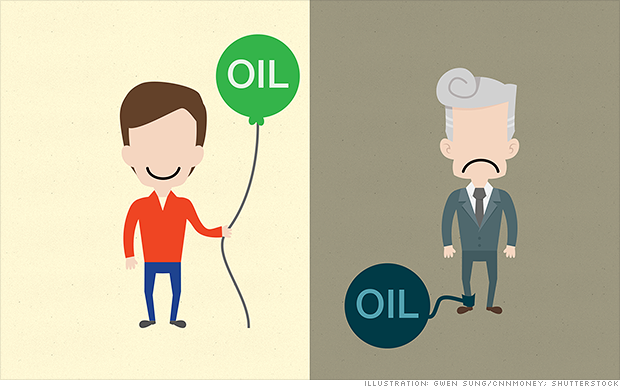

Falling oil prices are bringing smiles to millions of Americans, but they're also creating headaches for energy companies. Watch for this story to play out during the upcoming earnings season. NEW YORK (CNNMoney) For Corporate America, it really is a tale of two cities.

Falling oil prices are bringing smiles to millions of Americans, but they're also creating headaches for energy companies. Watch for this story to play out during the upcoming earnings season. NEW YORK (CNNMoney) For Corporate America, it really is a tale of two cities. It's the best of times for consumer and transportation companies. They are capitalizing on extremely cheap gas that's left consumers flush with cash.

As earnings season begins this week, these companies appear poised to reveal strong profit growth thanks to higher demand and lower energy costs.

On the other hand, it's the worst of times for the energy sector, which is bracing for a dramatic tumble in profits due to the surprise crash in oil prices. As oil fell from over $100 in the summer to below $50 now, everyone from Big Oil producers to drillers and oil services companies is taking a hit.

"For the energy sector, it will no doubt be a very difficult earnings season due to the sharp drop in oil prices," Burt White, chief investment officer at LPL Financial, wrote in a note to clients that raised the "tale of two earnings seasons" theme.

More ammo for the bull run? The divergence between the energy sector and the rest of the business world helps explain why the stock market has experienced such whiplash in recent days. Investors just can't decide how the oil meltdown will play out in the bigger picture.

But don't expect those energy troubles to ruin the party for everyone else.

"Overall, we expect more winners from cheap oil than losers, with another good performance by Corporate America," White wrote.

He's not the only one. Wall Street analysts are calling for fourth-quarter earnings at S&P 500 companies to climb by nearly 5%, according to S&P Capital IQ. That's pretty solid given the turbulence in the energy industry.

Healthy reports could give further ammo to the stock market, which experienced heavy turbulence last week and suffered a sell-off on Friday.

Alcoa (AA), the aluminum maker, is set to unofficially start the earnings period on Monday evening. It'll be quickly followed by big banks like Bank of America (BAC), Citigroup (C), Goldman Sachs (GS) and JPMorgan Chase (JPM).

Cashing in on low oil: The real story is about how cheap oil is creating big winners. It's easy to see how companies like Best Buy (BBY), Starbucks (SBUX) and! Target (TGT) will be helped by the fact that consumers are paying less at the pump, giving them more money to spend in the stores.

"I think lower oil prices are a great thing. It trickles through to so many other sectors of the economy. It's a net positive," said Christine Short, senior vice president at Estimize.

Thanks to the cheaper fuel costs, industrials should be another bright spot. The group is expected to grow profits nearly 10% as transportation companies like UPS (UPS) and Southwest Airlines (LUV) enjoy cheaper expenses and cash in on strong economic growth.

Likewise, manufacturers that don't have close ties to the energy sector should benefit from cheaper raw material costs caused by the oil meltdown.

The real stars will come later when health care companies report their quarterly results. Thanks to blockbuster growth from biotech companies like Gilead Sciences (GILD), the health care industry is projected to increase profits by a hefty 19% from the year before.

Trouble in the oil patch: It's a very different story for energy companies, whose shares have crumbled in recent months as analysts dramatically scale back their earnings estimates. They're now projecting a steep 21% plunge in fourth-quarter profits for the energy sector.

"Companies within or connected to the energy sector will likely have a difficult time due to the sharp, swift decline in oil prices," said White.

That helps explain why more than $200 billion worth of Big Oil's market valuation has been wiped out in recent months.

The pain is only expected to increase for the energy sector in 2015. Analysts are predicting a 39% profit plunge during the first quarter.

Crudeoil trading range for the day is 2859-3155 as researched by Epic research.

ReplyDeleteIts very interesting while reading it, thank you for posting such a good article.

ReplyDeleteVisit snacks manufacturing companies in india