According to GuruFocus list of 5-year lows, these Guru stocks have reached their 5-year lows: Science Applications International Corp, Grana y Montero SAA, Piedmont Office Realty Trust Inc, and OiSA

Science Applications International Corp (SAIC) Reached the Five-Year Low of $32.20

The prices of Science Applications International Corp (SAIC) shares have declined to close to the five-year low of $32.20, which is 26.3% off the five-year high of $39.88. Science Applications International Corp is owned by one Guru we are tracking. Among them, 1 have added to their positions during the past quarter. Zero reduced their positions. Science Applications International Corp has a market cap of $2.76 billion; its shares were traded at around $32.20 with a P/E ratio of 18.50 and P/S ratio of 0.45. The dividend yield of Science Applications International Corp stocks is 0.87%.

Science Applications International Corp announced their 2014 third quarter fiscal results with revenues of $974 million and net income of $22 million.

GuruFocus Guru Private Capital initiated its position in SAIC and bought 211,409 shares.

Director Robert A. Bedingfield bought 2,000 shares of SAIC stock on 12/17/2013 at the average price of $32.15.

Grana y Montero SAA (GRAM) Reached the Five-Year Low of $20.90

The prices of Grana y Montero SAA (GRAM) shares have declined to close to the five-year low of $20.90, which is 17.3% off the five-year high of $22.14. Grana y Montero SAA is owned by four Gurus we are tracking. Among them, four have added to their positions during the past quarter. Zero reduced their positions. Grana y Montero SAA was established in Peru on August 12, 1996 as a result of the equity spin-off of Inversiones GyM S. Grana Y Montero Saa has a market cap of $2.75 billion; its shares were traded at around $20.90 with a P/E ratio of 24.60 and P/S ratio of 1.24.

Grana y Montero SAA reported their 2013 third quarter results. The Company announced net income of S/. $135.8 million ! and revenues of S/. $2.8 billion.

Piedmont Office Realty Trust Inc. (PDM) Reached the Five-Year Low of $16.73

The prices of Piedmont Office Realty Trust Inc. (PDM) shares have declined to close to the 5-year low of $16.73, which is 32.6% off the five-year high of $21.32. Piedmont Office Realty Trust, Inc. is owned by one Guru we are tracking. Among them, 0 have added to their positions during the past quarter. One reduced their position. Piedmont Office Realty Trust Inc., a Maryland corporation was incorporated in 1987. Piedmont Office Realty Trust Inc. has a market cap of $2.7 billion; its shares were traded at around $16.73 with a P/E ratio of 33.10 and P/S ratio of 5.02. The dividend yield of Piedmont Office Realty Trust Inc. stocks is 4.78%. Piedmont Office Realty Trust Inc. had an annual average earnings growth of 27.60% over the past five years.

Piedmont Office Realty Trust Inc. reported 2013 third quarter results. The Company announced net income of $19.1 million and revenues of $145.1 million.

Director W Wayne Woody bought 792 shares of PDM stock on 08/21/2013 at the average price of $17.2.

Oi SA (OIBR) Reached the Five-Year Low of $1.63

The prices of Oi SA (OIBR) shares have declined to close to the five-year low of $1.63, which is 87.6% off the five-year high of $11.48. Oi SA is owned by three Gurus we are tracking. Among them, zero have added to their positions during the past quarter. 3 reduced their positions. Oi SA is a telecommunication service providing company in Brazil. Oi Sa has a market cap of $2.67 billion; its shares were traded at around $1.63 with a P/E ratio of 4.50 and P/S ratio of 0.14. The dividend yield of Oi Sa stocks is 23.36%. Oi Sa had an annual average earnings growth of 10.00% over the past 10 years.

OiSA announced their 2013 third quarter results with revenues of R$7.1 billion and net income of R$172 million.

GuruFocus Charles Brandes, who owns 751,723 shares as of Sept. 30, 2013, kept his position in Oi SA unchanged.

Go h! ere for the complete list of five-year lows.

Also check out: Charles Brandes Undervalued Stocks Charles Brandes Top Growth Companies Charles Brandes High Yield stocks, and Stocks that Charles Brandes keeps buying

| Currently 5.00/512345 Rating: 5.0/5 (1 vote) |

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

| Latest Guru Picks | Value Strategies | |||||

| Warren Buffett Portfolio | Ben Graham Net-Net | |||||

| Real Time Picks | Buffett-Munger Screener | |||||

| Aggregated Portfolio | Undervalued Predictable | |||||

| ETFs, Options | Low P/S Companies | |||||

| Insider Trends | 10-Year Financials | |||||

| 52-Week Lows | Interactive Charts | |||||

| Model Portfolios | DCF Calculator | |||||

RSS Feed  | Monthly Newsletters | |||||

| The All-In-One Screener | Portfolio Tracking Tool |

| Bank | Q1-Q2 04 OCI Change | Debt Portfolio | Loss as % of Portfolio |

| Bank of America (NYSE: BAC ) | ($2.7B) | $167B | 1.6% |

| JPMorgan Chase (NYSE: JPM ) | ($1.2B) | $65B | 1.8% |

| Citigroup (NYSE: C ) | ($2.7B) | $205B | 1.3% |

| Wells Fargo (NYSE: WFC ) | ($283m) | $37B | 0.8% |

Source: SEC filings. OCI changes reflects just the change in unrealized securities gains.

This is all very back-of-the-envelope and may not be a perfect apples-to-apples comparison across banks. But JPMorgan, at least, left little doubt as to what happened in the second quarter of 2004. In a footnote to its breakdown of OCI changes, the bank noted: "The net change for the six months ended June 30, 2004, is primarily due to rising interest rates."

Fast forward to today, and it's readily apparent that similar loss levels would be extremely painful. The banks' debt portfolios are much larger than they were in 2004 -- Wells Fargo's, for instance, went from $37 billion to $248 billion. Per bank, we're easily talking about billions of dollars, perhaps $5 billion or $6 billion on the upper end.

What's worse is that interest rate spreads have recently been tighter than in 2004, and new regulations have taken a bite out of some fee income. That means that -- compared to nine years ago -- there's less potential profit on the income statement to offset the balance sheet weakness.

What will be revealing in seeing the actual numbers is the ways in which each bank positioned itself in anticipation of rising rates (I mean, come on, who didn't see this coming?). Holding debt securities with shorter maturities, for example, could lead to significantly lower loss levels versus 2004. Investors in the sector will want to keep an eye out for banks that break from the pack -- either showing larger or smaller proportional losses. That could provide some insight into which management teams have their heads screwed on straight.

The upshot to this is that while the second-quarter earnings reports may include some ugly items, the rate movements over the past quarter will actually be a positive for the banks over the longer term. Spreads widened during the quarter -- that means the long-term rates rose more in relation to short-term rates. This is a distinct positive for banks since they make much of their money via those rate spreads. Higher rates in general are a positive as well. In its first-quarter SEC filing, JPMorgan noted that a 100-basis-point increase in interest rates would lead to a $2 billion increase in annual pre-tax net interest income. A 200-basis-point increase would boost net interest income by $3.7 billion.

Even when we compare the rate action over the past quarter to 2004, there are positives. In 2004, some parts of the yield curve were starting to flatten -- that is, basically the opposite of the spread-widening situation that I outlined above.

Source: U.S. Department of the Treasury.

The rate gains this year have been distinctly the good kind (if you're a bank), leading to a steepening curve.

Source: U.S. Department of the Treasury.

And here's the real optimistic slant on all of this: A steeper yield curve is typically seen as a sign of better economic times. A healthier, growing economy is good for banks. Of course, a healthier, growing economy is also good for all of us.

Time to buy banks?

Many investors are terrified about investing in big banking stocks after the crash, but the sector has one notable stand-out. In a sea of mismanaged and dangerous peers, it rises above as "The Only Big Bank Built to Last." You can uncover the top pick that Warren Buffett loves in The Motley Fool's new report. It's free, so click here to access it now.

Wednesday, January 21, 2015

Microsoft Stock and the Wrath of Gamers

Now that the major players have shown all their cards in the console wars, we know of two features of Microsoft's (NASDAQ: MSFT ) Xbox One that set it apart from competitors -- and not in a good way. The new Xbox is more expensive than either Sony's or Nintendo's systems, but that can be excused considering Microsoft decided to include its Kinect motion-sensing camera this time around. One thing that many consumers might not accept, though, is a new batch of restrictive digital rights policies that threaten to make things like loaning games to friends or playing with spotty access to the Internet much more complicated.

In the video below, Fool contributor Demitrios Kalogeropoulos argues that Microsoft has more to lose than just dollars and cents from a gamer revolt. Angry SimCity fans turned on Electronic Arts (NASDAQ: EA ) earlier this year for some of the same reasons, helping to get that company named "Worst in America" in an online poll at Consumerist.com. And Microsoft should have been taking notes, Demitrios says.

Mr. Softy is right that the industry will eventually go all-digital. But that moment isn't here yet, so Microsoft needs to address gamers' concerns about physical discs before it's too late.

It's been a frustrating path for Microsoft investors, who've watched the company fail to capitalize on the incredible growth in mobile over the past decade. However, with the release of its own tablet, along with the widely anticipated Windows 8 operating system, the company is looking to make a splash in this booming market. In a special premium report on Microsoft, a Motley Fool analyst explains that while the opportunity is huge, so are the challenges. The report includes regular updates as key events occur, so make sure to claim a copy of this report now by clicking here.

Should You Trade Pfizer Stock for Shares in Zoetis?

Owners of Pfizer (NYSE: PFE ) stock have an animal of a decision to make. The pharma giant is giving shareholders a chance to exchange Pfizer stock for shares in Zoetis (NYSE: ZTS ) , its former animal health business that was spun out in February. Pfizer still owns 80% of Zoetis but is willing to give its shares away to its current shareholders in exchange for retiring Pfizer stock.

Investors certainly don't want to feel like a fish out of water owning a new company, and sometimes a bird in the hand is worth two in the bush.

On the other hand, investors shouldn't look a gift horse in the mouth, especially one that may be the bee's knees.

Curiosity may have killed the cat, but let's chew the cud and take a look at what investors should do with their Pfizer stock. And I'll hold my horses with the animal sayings so we can get through the details.

If investors decide to exchange their Pfizer shares, they'll receive about $107.52 worth of Zoetis shares for every $100 worth of Pfizer shares, although there's a limit of 0.9898 shares of Zoetis stock per share of Pfizer stock. The values will be determined by the average price of the three days before the deal closes on June 19 after the closing bell.

Don't count your chickens before they hatch

The 7% discounts sounds like a good deal, but you have to want to own shares of Zoetis to justify making the exchange. There's no telling what Pfizer shares or Zoetis shares are going to do after the exchange before you might have a chance to sell them. If Pfizer is able to exchange all its shares, it's possible investors will be so happy to have gotten rid of Zoetis that they'll bid up the shares, negating the discount.

Zoetis looks like a solid company. Sales in the first quarter were up 5% year over year, which topped the 4% growth Merck (NYSE: MRK ) saw with its animal health division and solidly trumped Elanco, Eli Lilly's (NYSE: LLY ) animal health division, which saw sales up just 2%.

Being the largest animal health company, Zoetis should have some operational efficiencies that aren't available to Merck, Eli Lilly, Bayer, and Sanofi. And it's really the only choice if you want to specifically tap the animal health care market. The animal health divisions are tiny parts of the pharmaceutical companies overall revenue, so they're not likely to move the needle at Merck, Eli Lilly or one of the other larger players.

Pfizer is as happy as a clam

Pfizer isn't doing the exchange out of the goodness of its heart. The company said that a full exit from Zoetis would be accretive to Pfizer's earning per share starting next year.

The exchange will remove Zoetis' earnings that flow through Pfizer's financial statement, but it'll also lower the number of shares outstanding since the Pfizer stock has to be turned in to get shares of Zoetis. The exchange reduces the "per share" in the EPS and increases the earnings by reducing the dividend that doesn't have to be paid on the retired Pfizer stock.

Barking up the wrong tree

This doesn't have to be an all or nothing situation. If you want to own Zoetis, which looks potentially more stable than Pfizer although perhaps with slower growth, consider trading in just some of your Pfizer stock and own both companies.

And if you're on the lookout for other dividend-paying stocks, The Motley Fool has compiled a special free report outlining our nine top dependable dividend-paying stocks. It's called "Secure Your Future With 9 Rock-Solid Dividend Stocks." You can access your copy today at no cost! Just click here.

Monday, January 19, 2015

3 Under-$10 Stocks Moving Higher Into Breakout Territory

DELAFIELD, Wis. (Stockpickr) -- At Stockpickr, we track daily portfolios of stocks that are the biggest percentage gainers and the biggest percentage losers.

Must Read: Warren Buffett's Top 10 Dividend Stocks

Stocks that are making large moves like these are favorites among short-term traders because they can jump into these names and try to capture some of that massive volatility. Stocks that are making big-percentage moves either up or down are usually in play because their sector is becoming attractive or they have a major fundamental catalyst such as a recent earnings release. Sometimes stocks making big moves have been hit with an analyst upgrade or an analyst downgrade.

Regardless of the reason behind it, when a stock makes a large-percentage move, it is often just the start of a new major trend -- a trend that can lead to huge profits. If you time your trade correctly, combining technical indicators with fundamental trends, discipline and sound money management, you will be well on your way to investment success.

With that in mind, let's take a closer look at a several stocks under $10 that are making large moves to the upside.

Must Read: 10 Stocks George Soros Is Buying

Frontline

Frontline (FRO), through its subsidiaries, is engaged in the ownership and operation of oil tankers and oil/bulk/ore carriers. This stock closed up 5% to $1.45 in Thursday's trading session.

Thursday's Range: $1.39-$1.48

52-Week Range: $1.18-$5.18

Thursday's Volume: 895,000

Three-Month Average Volume: 881,852

From a technical perspective, FRO ripped higher here right above some near-term support at $1.28 with above-average volume. This spike to the upside on Thursday is starting to push shares of FRO within range of triggering a big breakout trade. That trade will hit if FRO manages to take out some key near-term overhead resistance levels at $1.49 to $1.61 with high volume.

Traders should now look for long-biased trades in FRO as long as it's trending above Thursday's intraday low of $1.39 or above more near-term support at $1.28 and then once it sustains a move or close above those breakout levels with volume that hits near or above 881,852 shares. If that breakout hits soon, then FRO will set up to re-test or possibly take out its next major overhead resistance levels at its 50-day moving average of $1.89 to $2. Any high-volume move above $2 will then give FRO a chance to make a run at $2.50.

Must Read: Must-See Charts: 5 Big Stocks to Trade for Big Gains

Full House Resorts

Full House Resorts (FLL) owns, develops, manages and invests in gaming-related enterprises. This stock closed up 3.3% to $1.23 a share in Thursday's trading session.

Thursday's Range: $1.21-$1.25

52-Week Range: $0.87-$3.03

Thursday's Volume: 55,000

Three-Month Average Volume: 39,880

From a technical perspective, FLL ripped higher here and broke out above some near-term overhead resistance at $1.20 with above-average volume. This stock recently pulled back from $1.35 to just under its 50-day moving average to its low of $1.05. Following that move, shares of FLL have now started to rebound and move back above its 50-day moving average at $1.08. This spike to the upside on Thursday is now starting to push shares of FLL within range of triggering a big breakout trade. That trade will hit if FLL manages to take out Thursday's intraday high of $1.26 to some more key overhead resistance at $1.35 with high volume.

Traders should now look for long-biased trades in FLL as long as it's trending above $1.20 or above its 50-day at $1.08 and then once it sustains a move or close above those breakout levels with volume that hits near or above 39,880 shares. If that breakout materializes soon, then FLL will set up to re-test or possibly take out its next major overhead resistance levels at $1.50 to $1.60, or even its 200-day moving average of $1.79.

Must Read: 7 Stocks Warren Buffett Is Selling in 2014

Sharps Compliance

Sharps Compliance (SMED) provides management solutions and services for medical waste, used health care materials and patient-dispensed unused or expired medications in the U.S. This stock closed up 3.6% to $4.50 a share in Thursday's trading session.

Thursday's Range: $4.36-$4.60

52-Week Range: $2.80-$5.90

Thursday's Volume: 185,000

Three-Month Average Volume: 32,457

From a technical perspective, SMED jumped notably higher here back above both its 50-day and 200-day moving averages at $4.50 with above-average volume. This spike to the upside on Thursday also pushed shares of SMED into breakout territory, since the stock took out some near-term overhead resistance at $4.55. Market players should now look for a continuation move higher on the short-term if SMED manages to take out Thursday's intraday high of $4.60 with high volume.

Traders should now look for long-biased trades in SMED as long as it's trending above Thursday's intraday low of $4.36 or above more near-term support at $4.13 and then once it sustains a move or close above Thursday's intraday high of $4.60 with volume that hits near or above 32,457 shares. If that move kicks off soon, then SMED will set up to re-test or possibly take out its next major overhead resistance levels at $4.90 to $5, or even $5.40 to its 52-week high at $5.90.

Must Read: 10 Stocks Billionaire John Paulson Loves in 2014

To see more stocks that are making notable moves higher, check out the Stocks Under $10 Moving Higher portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>5 Stocks Insiders Love Right Now

>>Beat the S&P With 5 Hated Short-Squeeze Stocks

>>3 Stocks Spiking on Big Volume

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including

CNBC.com and Forbes.com.You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.

Mike Khouw's GoPro Inc Trade

CNBC Options Action's Mike Khouw said on the show that he wants to take a long position in GoPro Inc (NASDAQ: GPRO) and he wants to use options to do so.

He explained that the stock is trading at 10 times sales and it has a market cap of $10 billion. Judging on these parameters it looks expensive, but it has been so volatile that anything is possible. Khouw explained that his trade is not based on a historical performance of the stock because there is only a couple of months of data. It is all about the future of GoPro Inc's business.

The simple way to make a bullish bet in this name is to buy the January 82.5 call option for $6.70. The breakeven for this trade is at $89.20 and it is very important to use limit orders because the bid ask spread is really wide.

Posted-In: Mike Khouw Options ActionCNBC Options Markets Media Trading Ideas

© 2014 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Related Articles (GPRO) Mike Khouw's GoPro Inc Trade Bull of the Day: Aramark (ARMK) - Bull of the Day Stocks Smashed As Dollar Strengthens Dow Down 240 Points; OMNOVA Solutions Shares Dip After Q3 Results GoPro Inc Extends Gains Amid High Expectations For Product Launch Top Performing Industries For September 24, 2014 Around the Web, We're Loving... We're Now Hiring Journalists for our Newsdesk! Better Manage Your Personal Finances How to Reinvest Your 401(k) to Buy a Business Exclusive Interview With Twitter's CEO Don't Miss The Next Webinar to Advance your Trading Benzinga's Premarket Show and Interview Archive View the discussion thread. Partner NetworkSaturday, January 17, 2015

Why Atlanta is ripe for innovation

Rohit Malhotra, far right, with a group of people from the mayor's office and city council. NEW YORK (CNNMoney) Atlanta is one of the best cities in the country to be an innovator.

Rohit Malhotra, far right, with a group of people from the mayor's office and city council. NEW YORK (CNNMoney) Atlanta is one of the best cities in the country to be an innovator. It's the second most affordable city in the country, while entrepreneurs in other cities cram themselves into small "hacker hostels" to make ends meet. Over the past five years, the city attracted over $700 million in private investment through InvestAtlanta, and Atlanta added nearly $100 million to its cash reserves.

Equally notably, the city is re-embracing the social movements embedded in its history and is investing in historic landmarks, as seen through the launch of the Center for Civil and Human Rights and the expansion of the Sweet Auburn Curb Market on Edgewood. Even Outkast is back!

But some boats aren't rising with the tide. Children in Atlanta have only a 4% chance of upward mobility, and Atlanta has the highest income inequality in the United States. This creates a tale of two cities within the city I call home.

Civic entrepreneurs can help close the gap.

A civic entrepreneur is someone with a product or service that solves a public challenge. In Atlanta, civic entrepreneurs are finding new ways to solve local challenges -- like Jason Martin, who built the STE(A)M Truck, a mobile education lab for teaching science and math to students, and Brian Preston, who runs Lamon Luther, a high-end furniture company that transforms homeless men into craftsmen.

Public organizations in Atlanta, both government and nonprofits, can help grow the market of civic entrepreneurs immediately by doing two things: First, open up more government data, and second, make it easier to invest in local civic entrepreneurs.

Because government data is usually messy and disorganized, the decisions to keep or cut important programs are often left to gut reactions. Opening the data can open up a new economic opportunity and help public organizations make more informed decisions.

As the Open500 project showcases, hundreds of national companies use open government data as part of their business model. This includes seven Georgian companies, ranging from powerhouses like the Weather Channel and Blackrock to startups like Atlanta's own Department of Better Technology, which brings government into the 21st century through more sensible RFP processes.

The more data that is opened up, the more entrepreneurs will be inspired to launch businesses that solve th! e city's problems. States like Massachusetts, California and New York have strong open data standards and, consequently, a large number of businesses built on public data.

Civic entrepreneurs are not building charities: They are building businesses with the strategy of a private enterprise but the limited resources of a nonprofit. They need seed capital to test and prove their ideas. This is where public organizations can step in.

Public organizations and local governments can provide first contracts to civic entrepreneurs, which lets public agencies experiment with new ways of delivering services, often at a rate far below market.

In Philadelphia, City Hall partnered with Wharton, social accelerator GoodCompany Group and Code for America to create FastFWD, a competition that helps civic entrepreneurs secure government contracts on pertinent community challenges like public safety. One of the winners was Atlanta-born Village Defense, an easy to use, neighbor-to-neighbor communications tool that curbs crime by up to 80%.

In order to bring those kind of partnerships to Atlanta, I am launching the Center for Civic Innovation. It will serve as a lab for civic entrepreneurs to test new ideas on public challenges. The work of CCI is guided by a Civic Innovation Council made up of young leaders from across sectors in Atlanta.

The center's first initiative is a partnership with the Atlanta Community Food Bank to find new approaches to tackling food security in the city, where almost 800,000 people require the support of food pantries and meal service programs. Lessons from this pilot program can be applied to systemic issues impacting Atlanta, including workforce development, education and transportation.

If Atlanta can create a strong ecosystem for civic innovators, it will create a ripple effect for other cities with high levels of income inequality. Civic innovators will redefine the way donors and taxpayers expect their money to be used, and ci! ties can ! reinvent the way services are delivered to their residents. This is a moment for leaders in Atlanta to, once again, redefine history for the rest of the country.

Rohit Malhotra is the executive director and founder of the Center for Civic Innovation in Atlanta, his hometown. Most recently, he served as an Ash Innovation Fellow in the White House Office of Management and Budget.

Thursday, January 15, 2015

Cashing in already on California Chrome

Inside Belmont: Race for the Triple Crown NEW YORK (CNNMoney) Horse racing fans are no strangers to betting. But many of them are apparently making an unusual bet this weekend, planning to not cash in a winning ticket if California Chrome becomes the first Triple Crown winner since 1978.

Inside Belmont: Race for the Triple Crown NEW YORK (CNNMoney) Horse racing fans are no strangers to betting. But many of them are apparently making an unusual bet this weekend, planning to not cash in a winning ticket if California Chrome becomes the first Triple Crown winner since 1978. California Chrome is such a strong betting favorite in the Belmont Stakes after taking the Kentucky Derby and Preakness wins a winning $2 bet will only pay a little over $3 to the holder of the ticket.

But as a piece of sports memorabilia, it could be worth quite a bit more in the future.

So people are buying the tickets with the plan to hold onto them. Some of the tickets have already sold on eBay (EBAY, Tech30) for as much as $5.59, or $14.99 for a set of five. Those prices are likely to climb sharply if California Chrome can actually win Saturday.

Stephen Costello, executive vice president of Steiner Sports, a sports memorabilia seller, said a winning $2 ticket from Affirmed, the last horse to win the Triple Crown, is worth between $200 to $300 today. But there's a far more limited supply of those tickets on the market, since few people were thinking of the future memorabilia value of the tickets at that time of that race.

Ride Belmont like California Chrome

Ride Belmont like California Chrome "I think if you had that ticket, you most likely cashed it," said Costello.

If there is a greater supply of the winning tickets on the memorabilia market after this year's race, it will limit the price they'll fetch. But Costello said the popularity of the horse and the greater interest in owning souvenirs will likely mean the tickets could eventually be worth as much as $100.

"If he wins, it's an historic event. And at the end of the day, people love this horse," he said.

Wednesday, January 14, 2015

10th Annual SMA Managers of the Year Revealed; Tom Johnson Takes Top Honors

In Chicago Thursday morning at the 2014 Envestnet Advisor Summit, Investment Advisor and Envestnet|PMC announced the winners of the 10th annual SMA Managers of the Year.

Throughout the awards’ history, analysts from Envestnet (originally Prima Capital before its acquisition and rollup into Envestnet | PMC in 2012) and editors from Investment Advisor looked beyond each SMA strategy’s one-year returns to find those that consistently outperform their peers over time, following a clearly defined, sustainable and repeatable alpha strategy. With seven total award winners in five categories, and an overall SMA Manager of the Year, we honor strategies that are an important part of the firm’s overall corporate strategy, reflected in our assessment that the firm’s human capital can replicate that repeatable, sustainable investment strategy.

In our deliberations, we consider only those strategies that:

Announced as SMA Managers of the Year in the U.S. Equity large-cap category this year is, first, Dana Investment Management for its Large Cap Equity portfolio. In the selection committee’s deliberations, PMC’s analysts noted that Brookfield, Wis.-based Dana’s “alpha generation has been extremely consistent over time,” helped by the fact that lead portfolio manager Duane Roberts has managed the strategy since its July 1999 inception. What sets them apart? Their sector-neutral, extremely structured process.

The second winner in the U.S. equity large cap category is Robeco Investment Management for its Boston Partners Large Cap Value portfolio.

In assessing Los Angeles-based Robeco for its Large Cap Value strategy, PMC’s analysts highlighted the minimal turnover on this firm’s research team of 20 experienced analysts, and the portfolio’s identifiable and sustainable competitive advantages: its clearly articulated alpha thesis and consistent alpha generation.

In the U.S. equity mid-, small or SMID-cap category, there were two winners as well. Philadelphia-based Glenmede Investment Management won for its Small Cap Equity portfolio. In assessing the product, one PMC analyst said simply that Glenmede “crushed it in 2013.” Led by portfolio managers Bob Mancuso and Chris Colarik, the strategy operates in a crowded area, making it even more impressive that its emphasis on buying quality companies has provided investors over the past 10 years with a product that has generated 181 basis points of annualized alpha.

The second winner in the category was Reinhart Partners for its Mid Cap Private Market Value strategy.

PMC’s analysts highlighted Reinhart’s unique investing process that helps pick names for the portfolio by assigning an intrinsic value to companies through finding comparable companies that were recently involved in a merger or acquisition. Lead portfolio manager Brent Jesko also eats his own cooking: all of his liquid worth is invested in the portfolio.

In the third category, international or global equity, Denver-based Cambiar Investors won for its International ADR product.

PMC analysts called Cambiar a “successful organization, with widespread equity ownership among employees, a stable and highly experienced team which focuses on a select number of related strategies” and has produced over its now eight-year-old strategy’s lifespan annual alpha of more than 2%.

The fourth category is that of fixed income, where Oklahoma City-based Tom Johnson Investment Management won for its Intermediate Fixed Income strategy.

In recommending Tom Johnson as a winner in this category, PMC’s analysts said it was the “most worthy candidate” in the category, considering its top-quartile three-year absolute performance and its top quartile three and five-year risk adjusted returns, and the firm’s commitment to the space: nearly a third of the company’s total assets are invested in this strategy.

The final category award — the Speciality award, which is given to a strategy that doesn’t fit into one of the major categories — was presented this year to Cushing Investment Management for its MLP Alpha Total Return Strategy.

In recommending Cushing, the PMC analysts said this SMA of master limited partnerships in the energy industry stands on the research conducted by its 18 analysts who assess not only each MLP’s growth prospects but its business model, strategic footprint and quality of management as well.

In the final award presentation, the overall SMA Manager of the Year, selected from among our category winners, was presented to Tom Johnson Investment Management for its Intermediate Fixed Income strategy. This award could only be won by a successful manager who stood out through overperformance over an extended period of time, exhibiting consistency in its alpha thesis and demonstrating a sustainable and repeatable investment process over multiple business and market cycles.

When discussing who should win this award, the committee was first impressed with the Tom Johnson product’s positive return in 2013, a dismal year for fixed income, but more notable was the product’s high performance over both the last three and five-year periods on both an absolute basis and on a risk-adjusted basis. The Committee also thought Tom Johnson worthy of praise for its “exceptional client service,” for its investment team’s extensive tenure together, and for the employee-owned firm’s culture.

Return soon to ThinkAdvisor for video coverage of the award winners, including individual interviews, and to Investment Advisor, where our July cover story will focus on these successful managers.

---

Check out these related stories on ThinkAdvisor:

Monday, January 12, 2015

What’s Behind GrainCorp’s Latest Selloff?

While we certainly would have enjoyed booking the gain that would have resulted had Archer Daniels Midland Co’s (NYSE: ADM) AUD3.2 billion bid to acquire GrainCorp Ltd (ASX: GNC, OTC: GRCLF) not been rejected by the Australian government, the deal was always somewhat bittersweet insofar as it meant we’d be foregoing the years of growth and income we’d hoped the stock would generate.

Now, of course, we have that opportunity again, though in the short term, the experience of owning GrainCorp’s shares since the deal fell through has been mostly bitter. The stock has fallen 32.1 percent since Treasurer Joe Hockey issued the politically motivated ruling that ADM’s acquisition of GrainCorp would be “contrary to the national interest.” That erased all of the deal’s premium, and for much of December and January, GrainCorp’s shares traded near where they’d been in late 2012 prior to ADM’s bid.

However, this week GrainCorp’s stock fell another 5.5 percent in local currency terms, which was 4.5 percentage points more than the broad Aussie market, as represented by the S&P/ASX 200. It also lagged more relevant benchmarks by similar amounts.

Though it’s reasonable to expect a stock to drop by the amount of the premium being offered once the bid for its acquisition is spurned, the additional selloff this week prompted understandable concern among some subscribers.

This week’s price decline appears to have been prompted by two news stories. The first was a report from Reuters detailing new competition the firm will face as emboldened competitors challenge its dominance now that it won’t necessarily be able to rely upon ADM’s deep pockets.

Western Australian grain exporter CBH Group is teaming with commodities trader Glencore Xstrata, among others, to build a new grains terminal on Australia’s east coast, not too far away from one of GrainCorp’s terminals, and it’s expected to open next month. CBH is also looking into the possibility of building storage sites in the country’s eastern states. Meanwhile, Reuters says tiny Melbourne-based Emerald Grain, which is partly owned by Japan’s Sumitomo Corp, is building up-country silos.

Despite this burgeoning competition, GrainCorp still holds the considerable advantage of incumbency in its territory. Indeed, the company’s network handles approximately 85 percent of the bulk-grains market trade in eastern Australia via its ownership of 280 up-country storage sites and seven grain port terminals.

Equally important, ADM still owns nearly 20 percent of GrainCorp’s shares outstanding and has the option to increase its holdings to 25 percent, which means the company is very much incentivized to ensure that it earns a proper return on its substantial stake. The wording of the government’s ruling also suggested that it would be open to approving a deal in the future once the industry further matures–it only just deregulated in 2008–and should ADM make inroads into assuaging concerns that underpinned political opposition to the deal among rural constituents.

In the meantime, GrainCorp would definitely benefit from a financial infusion to help upgrade key infrastructure, such as rails. Management has acknowledged that without ADM’s superior financial backing, its growth will occur at a slower pace as it deploys its own capital toward upgrades while rationalizing its storage and logistics division. Perhaps GrainCorp’s newfound competition will motivate ADM to find a way to offer additional financial support. We wouldn’t rule it out.

The other story this week, courtesy of The Australian, detailed how compensation for the company’s executives had soared to AUD13.6 million from AUD6.9 million a year earlier, largely due to the jump in share price resulting from ADM’s bid. The departure of key executives, such as soon-to-be former CEO Alison Watkins, also triggered the payout of accrued bonuses. Any boost in pay resulting from the aborted deal will certainly cause ire among shareholders, and it sounds like the board will reverse any compensation schemes tied to that deal.

When a stock is already suffering from negative sentiment, stories like these can cause it to fall much harder than it would during more optimistic times. But GrainCorp’s dominance of the region in which it operates along with its exposure to emerging Asia mean that it should still reward long-term investors.

How to outperform using boring old index funds

One of the most common knocks against index funds is that they guarantee you average returns minus fees and, by golly, clients need above average returns or else they're going to start looking for a new adviser.

But it's silly to think that the only way an adviser can add alpha to a client's portfolio is by finding the next hot fund manager, sector or stock.

In fact, for advisers, adding alpha is as simple as making savvy tax moves and as stopping clients from making classic investing mistakes like buying high, selling low and thinking short-term instead of long-term. These are all basic things that mom-and-pop investors probably aren't thinking about on their own. And these are things that an adviser can actually control, unlike, say, the market's returns.

So even by using index funds, which are designed to give investors the market's return, minus fees, an adviser can add performance to a client's portfolio that they likely wouldn't get on their own.

“Advisers are the alpha,” said Martha King, managing director of The Vanguard Group Inc.'s financial adviser services division.

“It's not about stock picking anymore,” she said. “Advisers can make a difference through their coaching and their guidance. They add value through building the relationship and helping clients be clear about their life goals.”

The shift is already well under way within the financial advice industry, but becoming comfortable with pitching themselves as the alpha to clients, rather than promising to kick the pants off the market, is one of the biggest challenges advisers face this year, Ms. King said.

“Many advisers are still in the midst of that turn,” she said.

Some major institutions also are in deeply involved in helping advisers make that turn as well. Bank of America Merrill Lynch, for example, is in the middle of a five-year strategic plan to shift its focus to goals-based wealth management.

Of course, this doesn't mean active management has no room in a portfolio. Focusing on long-term planning will also benefit advisers using actively managed funds, since research has shown that finding above-average long-term outperformance from an active manager requires a great deal of patience.

Two-thirds of the 275 actively managed stock funds that outperformed over the 15-year period ended Dec. 31, 2012, suffered at least three consecutive years of underperformance, for example, according to Vanguard.

So really, thinking about yourself as alpha rather than spending time and resources trying to find it in the market, is a win for you and for your clients.

Sunday, January 11, 2015

Get ready for a tale of two earnings seasons

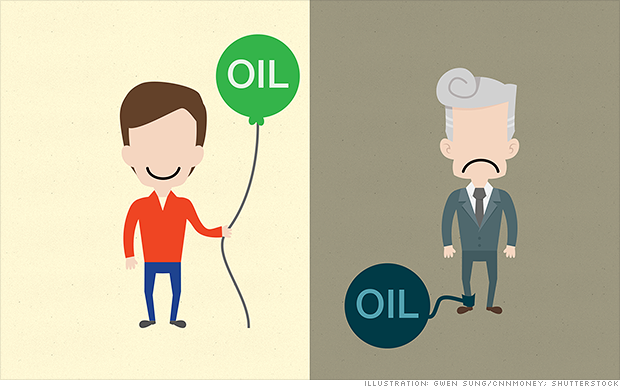

Falling oil prices are bringing smiles to millions of Americans, but they're also creating headaches for energy companies. Watch for this story to play out during the upcoming earnings season. NEW YORK (CNNMoney) For Corporate America, it really is a tale of two cities.

Falling oil prices are bringing smiles to millions of Americans, but they're also creating headaches for energy companies. Watch for this story to play out during the upcoming earnings season. NEW YORK (CNNMoney) For Corporate America, it really is a tale of two cities. It's the best of times for consumer and transportation companies. They are capitalizing on extremely cheap gas that's left consumers flush with cash.

As earnings season begins this week, these companies appear poised to reveal strong profit growth thanks to higher demand and lower energy costs.

On the other hand, it's the worst of times for the energy sector, which is bracing for a dramatic tumble in profits due to the surprise crash in oil prices. As oil fell from over $100 in the summer to below $50 now, everyone from Big Oil producers to drillers and oil services companies is taking a hit.

"For the energy sector, it will no doubt be a very difficult earnings season due to the sharp drop in oil prices," Burt White, chief investment officer at LPL Financial, wrote in a note to clients that raised the "tale of two earnings seasons" theme.

More ammo for the bull run? The divergence between the energy sector and the rest of the business world helps explain why the stock market has experienced such whiplash in recent days. Investors just can't decide how the oil meltdown will play out in the bigger picture.

But don't expect those energy troubles to ruin the party for everyone else.

"Overall, we expect more winners from cheap oil than losers, with another good performance by Corporate America," White wrote.

He's not the only one. Wall Street analysts are calling for fourth-quarter earnings at S&P 500 companies to climb by nearly 5%, according to S&P Capital IQ. That's pretty solid given the turbulence in the energy industry.

Healthy reports could give further ammo to the stock market, which experienced heavy turbulence last week and suffered a sell-off on Friday.

Alcoa (AA), the aluminum maker, is set to unofficially start the earnings period on Monday evening. It'll be quickly followed by big banks like Bank of America (BAC), Citigroup (C), Goldman Sachs (GS) and JPMorgan Chase (JPM).

Cashing in on low oil: The real story is about how cheap oil is creating big winners. It's easy to see how companies like Best Buy (BBY), Starbucks (SBUX) and! Target (TGT) will be helped by the fact that consumers are paying less at the pump, giving them more money to spend in the stores.

"I think lower oil prices are a great thing. It trickles through to so many other sectors of the economy. It's a net positive," said Christine Short, senior vice president at Estimize.

Thanks to the cheaper fuel costs, industrials should be another bright spot. The group is expected to grow profits nearly 10% as transportation companies like UPS (UPS) and Southwest Airlines (LUV) enjoy cheaper expenses and cash in on strong economic growth.

Likewise, manufacturers that don't have close ties to the energy sector should benefit from cheaper raw material costs caused by the oil meltdown.

The real stars will come later when health care companies report their quarterly results. Thanks to blockbuster growth from biotech companies like Gilead Sciences (GILD), the health care industry is projected to increase profits by a hefty 19% from the year before.

Trouble in the oil patch: It's a very different story for energy companies, whose shares have crumbled in recent months as analysts dramatically scale back their earnings estimates. They're now projecting a steep 21% plunge in fourth-quarter profits for the energy sector.

"Companies within or connected to the energy sector will likely have a difficult time due to the sharp, swift decline in oil prices," said White.

That helps explain why more than $200 billion worth of Big Oil's market valuation has been wiped out in recent months.

The pain is only expected to increase for the energy sector in 2015. Analysts are predicting a 39% profit plunge during the first quarter.

Saturday, January 10, 2015

Adidas in 2014: What a Disappointing Year!

Dieser Artikel war auf Fool.de originell veröffentlicht. Klick hier, um es auf Deutsch lesen. Du kannst auch Motley Fool Deutschland auf Facebook folgen.

(Figures in this article reflect prices as of market close on 12/19/2014 unless otherwise specified.)

It's easy to see that 2014 was a miserable year for Adidas' (ETR:ADS) stock. But what's important for investors is to understand why it was such a bad year, and whether the problems at Adidas are fixable or will keep the athletic brand in the penalty box for years to come.

The year was supposed to be a strong one driven by World Cup revenues and Germany winning the title for the fourth time should have provided more cause for celebration (and an additional boost to sales). However, one disappointing quarter followed another, and in late July the company management issued a profit warning for 2014. Adidas also acknowledged that the 2015 long-term goals would also not be achieved. As a result, the share price dropped sharply and -- apart from a brief rally after third quarter earnings -- has yet to recover. The stock is currently trading almost 40% below its all-time high, reached at the beginning of the year, making it the worst performing DAX stock in 2014. The below graph shows the dramatic drop over the year:

Source: OnVista.

So what went wrong in 2014? Let's look at the key reasons that contributed to the company's dismal performance.

Sales in Western Europe and North America struggled

Adidas has lost a lot of ground to Nike (NYSE: NKE ) in the key Western Europe and North America markets, which add up to about half of global sales. The below table shows the year-over-year sales growth for the last three (for Nike, four) reported quarters:

| Q1 | Q2 | Q3 | Q4 | Total | ||

| Western Europe | Adidas | 0% | 14% | 9% | 7% | |

| Nike | 19% | 18% | 25% | 24% | 22% | |

| North America | Adidas | -20% | 1% | -1% | -7% | |

| Nike | 12% | 10% | 12% | 16% | 12% |

Source: Adidas and Nike quarterly reports; currency-adjusted sales growth vs. prior year.

Even though Adidas will report fourth quarter earnings in early 2015, it seems very likely that it has lost the title of No. 1 sportswear company in Western Europe to its arch-rival. Nike had an extremely strong 2014 in the region and its sales grew by 22% to reach around 4.2 billion euros. Adidas would have to increase its fourth quarter sales by more than 25% compared to prior year in order to retain its leading position. Based on the last quarters' performance, such a strong growth is extremely unlikely.

In North America, both Nike and relative newcomer Under Armour (NYSE: UA ) have outperformed Adidas, pushing it back to third place in the first nine months of the year.

This does not bode well for the German company. Growing in the emerging markets is essential, but having a strong position in one's core markets is equally important, and Adidas is falling behind in both of its core regions.

A decline in the popularity of golf was hurting Adidas' golf business

The golf industry is having structural problems. Participation rate is dropping and, especially among young people, there is a growing disinterest for a sport that takes too long to play, doesn't have the intensity of other sports, and doesn't have a true star player with major appeal any more.

Adidas, together with other golf apparel manufacturers, started to feel the negative impacts of this trend in 2014. In the first nine months of the year, sales at TaylorMade-adidas Golf dropped by 29% (on a currency-neutral basis) and operating profits were 150 million euros below 2013 levels. The segment represented 9% of total sales in 2013, so this structural decline will continue to be a strategic challenge.

Business in Russia was negatively affected by the geopolitical tensions

Adidas has a traditionally strong business in Russia with a network of over 1,100 stores. As a result of the recent geopolitical developments, however, consumer sentiment has been falling in the country. To counter this, Adidas had to rely on strong promotional efforts to clear its inventory, driving down margins. The weakening ruble further decreased profitability.

All in all, the Russia region caused roughly a 100 million euros negative profit impact in the first nine months. After the development over the last weeks -- a further sharp fall in the value of the ruble, coupled with a big increase in interest rates -- it is very likely that the coming quarters will bring further negative news for the company.

Currency developments had a significant negative impact on the results

The ruble was not the only currency causing problems. Many currencies across Asia and Latin America also weakened compared to the euro on a year-over-year basis. As a result, while sales increased by 6% in the first nine months on a currency-neutral basis, reported sales growth was only 1%. In euro terms this meant 550 million euros less in sales due to currency translation. On the profitability side, margins were down by about 50 basis points and operating profits were affected by roughly 150 million euros.

In the fourth quarter, the sharp drop in the Russian ruble will cause further translation losses and margin erosion. However, the recent strengthening of the US dollar should bring some positive impact to the North American market, as every US dollar received from the North American customers will be worth more euros.

Financial results of 2014 are worsening

As a result of the above-mentioned problems, the financial performance of Adidas was significantly worse in the first nine months of 2014 than in the previous year. While sales grew by 1%, operating profit was down almost 20%. Operating margins dropped 2.2% points to 8.3%. On the cash flow side, the company used a hundred million euros more in operating activities than the year before.

Full-year results are also expected to follow this trend. While currency-neutral sales are expected to show single-digit growth, net income is expected to drop from 839 euros million in 2013 to around 650 million euros for the full year in 2014.

What does all this mean?

After five years of strong share price performance between 2009 and 2013, during which the stock value quadrupled, Adidas had a reversal of fortunes in 2014. Some of this, like the currency developments or geopolitical tensions, is out of the company's control. However, some other issues such as losing market share in Europe and North America are largely driven by the actions by Adidas and its competitors and are worrying developments for the future.

What should you look out for in 2015? Are there reasons to buy Adidas shares? Are there reasons to sell them? We will look at these questions in coming articles -- so make sure you stay tuned to fool.de.

You can't afford to miss this

"Made in China" -- an all too familiar phrase. But not for much longer: There's a radical new technology out there, one that's already being employed by the U.S. Air Force, BMW, and even Nike. Respected publications like The Economist have compared this disruptive invention to the steam engine and the printing press; Business Insider calls it "the next trillion dollar industry." Watch The Motley Fool's shocking video presentation to learn about the next great wave of technological innovation, one that could bring an end to "Made In China" for good. Click here!

Good Samaritan fired by Wal-Mart says he won’t …

Kristopher Oswald, 30, of Linden, Mich., said Thursday that Bentonville, Ark.-based Wal-Mart has been "unwilling to compromise" in negotiating his return to his job, which he lost Oct. 15 after assisting a woman two days earlier who had screamed for help in the store parking lot.

STORY: Wal-Mart offers good Samaritan job back

STORY: Court says OK to fire 'irresistable' worker

"The entire situation has left me with incredible anxiety," Oswald said. "Wal-Mart feels it's absolutely not their responsibility to help an associate harmed while on the clock. I have refused their offer to take my job back for fear of retaliation.

"They could not guarantee that nothing would happen from management if I did take my job," he said. "It's a day-to-day struggle. I feel like if I say the wrong thing, I'm going to have a company coming after me."

Oswald initially had said that work was scarce in the area in which he lives, about 45 miles northwest of Detroit, and that he fought hard to get his Wal-Mart job about 20 miles from his house.

Messages to Wal-Mart's corporate public information office for comment have not been returned.

Wal-Mart fired Oswald, who had an $8.70-an-hour job stocking pet supplies overnight at Hartland, Mich., store, because it said he had violated company policy in helping the 18-year-old woman, whose former boyfriend was later arrested and charged with drunken driving, malicious destruction of property and domestic violence.

<!--iframe-->

After Oswald's story was disseminated nationally and reaction against the company on social-media sites such as Twitter was scathing, the company reconsidered its stance Oct. 18 and offered Oswald his job back.

Oswald said he wants the company to issue a formal apology"and eliminate from his personnel record that he was fired for vio! lating store policy.

Oswald said he tried to help the woman, but her alleged attacker, whom police identified as Dylan Tierney, 17, of Milford, Mich., assaulted him and threatened to kill him. The fight ended when Tierney and two friends who joined Tierney left after Oswald's co-workers came to his aid.

Livingston County Sheriff Bob Bezotte said the dispute between Tierney and his former girlfriend began earlier in the evening at a party. The woman was walking down the road when Tierney tried to stop her and get her to return to the party.

Then Tierney tried to run the woman over, Bezotte said, but she was able to move out of the way before he struck her. The victim had a girlfriend pick her up and transport her to the Hartland Wal-Mart where she had parked her car, and Tierney and his two friends followed.

Tierney was taken into custody after tussling with Oswald when deputies stopped his vehicle, the sheriff said. Bezotte previously praised Oswald for getting involved and coming to the woman's assistance.

Tierney returns Tuesday to Livingston County District Court in Howell, Mich. He is free on a $1,000 bond, and that worries Oswald.

"He lives less than a half hour from my house," Oswald said. "And that concerns me."

An outdoors sign for Walmart is seen in Duarte, Calif.(Photo: By Damian Dovarganes, AP)

Friday, January 9, 2015

The Deal: Umpqua Pays $2B for Sterling Financial

NEW YORK (The Deal) -- Umpqua Holdings (UMPQ) said Thursday, Sept. 12, it would acquire private equity-backed Sterling Financial (STSA) in a $2 billion deal that would create a massive West Coast regional bank.

Terms of the deal call for Portland, Ore.-based Umpqua to pay 1.671 shares and $2.18 in cash for each share of Sterling for total consideration of $30.52 a share, a premium of 26% over Sterling's price on Aug. 30, prior to word of a potential deal going public.

Private-equity firms Thomas H. Lee Partners LP and Warburg Pincus LLC, who each own about 20.8% of Sterling, have agreed to vote their shares in favor of the deal.

The deal would create a banking franchise with $22 billion in assets, $15 billion in loans and $16 billion in deposits and 394 branches spread across Oregon, Washington, Idaho, California and Nevada. It continues the aggressive expansion strategy of the one-time South Umpqua State Bank under the direction of CEO Ray Davis, which has included a number of deals for institutions that were battered by the downturn. Spokane, Wash.-based Sterling turned to private equity in 2010 to raise capital, raising $442 million from Thomas H. Lee and Warburg Pincus. The bank in the years since has done a series of buys and sales to revamp its branch network, establishing itself as an attractive target in the process. Josh Bresler, a managing director at THL, called the deal "the logical next step for Sterling," saying the merger "pairs two companies with exceptional management teams and franchises." Umpqua's Davis, who will remain CEO post-deal, said the merger will create a lender with the scale necessary to compete with banking giants. "With our size, shared cultures and financial strength, our combined organization will be uniquely positioned to deliver value for our associates, customers, communities and shareholders," Davis said. "We look forward to starting the process of bringing our companies together." Post-deal Sterling CEO Greg Seibly will join Umpqua as co-president, and Sterling representatives will take four seats on Umpqua's 13 director board. Umpqua was advised by J.P. Morgan Securities LLC and Wachtell, Lipton, Rosen & Katz, while Sandler O'Neill + Partners LP and Davis Polk & Wardwell LLP advised Sterling. A Weil, Gotshal & Manges LLP team of Michael Aiello and Heath Tarbert advised THL Partners, while Warburg Pincus tapped a Kirkland & Ellis LLP team of Eunu Chun, William Sorabella, Sergio Urias and Christian Nagler.

--Written by Lou Whiteman

Thursday, January 8, 2015

NHB's Rs 3750cr tax free bonds issue to open on March 11

The company aims to raise Rs 3,750 crore through this issue.

NHB is also allowed to raise funds through private placement route in one or more tranches not exceeding Rs 1,250 crore i.e. up to 25 percent of the allocated limit of Rs 5,000 crore for raising funds through tax free bonds during fiscal 2012-13.

The company operates as a principal agency to promote housing finance institutions both at local and regional levels and to provide financial and other support to such institutions.

Bids can be made for minimum one bond and in multiples of 1 bond thereafter. The issue will close on March 15, 2013.

Coupon rate for retail investors and HUFs (who apply for bonds aggregating upto and including Rs 10 lakh) is 7.32 percent while for other investors the coupon rate is 6.82 percent.

Interest will be paid annually. The redemption of bonds will take place after 10 years from deemed date of allotment.

The rating agencies CRISIL and CARE assigned AAA rating to the issue.

The bonds are proposed to be listed on the National Stock Exchange.

Kotak Mahindra Capital Company Limited, Axis Capita Limited, ICICI Securities Limited and SBI Capital Markets Limited are the lead manager to the issue.

Tuesday, January 6, 2015

Axiall Goes Red

Axiall (NYSE: AXLL ) reported earnings on May 7. Here are the numbers you need to know.

The 10-second takeaway

For the quarter ended March 31 (Q1), Axiall missed estimates on revenues and whiffed on earnings per share.

Compared to the prior-year quarter, revenue grew significantly. Non-GAAP earnings per share dropped. GAAP earnings per share contracted to a loss.

Gross margins grew, operating margins grew, net margins shrank.

Revenue details

Axiall reported revenue of $1.06 billion. The seven analysts polled by S&P Capital IQ anticipated sales of $1.12 billion on the same basis. GAAP reported sales were 23% higher than the prior-year quarter's $859.9 million.

Source: S&P Capital IQ. Quarterly periods. Dollar amounts in millions. Non-GAAP figures may vary to maintain comparability with estimates.

EPS details

EPS came in at $0.75. The nine earnings estimates compiled by S&P Capital IQ predicted $1.18 per share. Non-GAAP EPS of $0.75 for Q1 were 5.1% lower than the prior-year quarter's $0.79 per share. GAAP EPS were -$0.06 for Q1 against $1.01 per share for the prior-year quarter.

Source: S&P Capital IQ. Quarterly periods. Non-GAAP figures may vary to maintain comparability with estimates.

Margin details

For the quarter, gross margin was 15.3%, 330 basis points better than the prior-year quarter. Operating margin was 7.0%, 50 basis points better than the prior-year quarter. Net margin was -0.3%, 440 basis points worse than the prior-year quarter. (Margins calculated in GAAP terms.)

Looking ahead

Next quarter's average estimate for revenue is $1.34 billion. On the bottom line, the average EPS estimate is $1.50.

Next year's average estimate for revenue is $4.95 billion. The average EPS estimate is $5.19.

Investor sentiment

Of Wall Street recommendations tracked by S&P Capital IQ, the average opinion on Axiall is outperform, with an average price target of $61.38.

Looking for alternatives to Axiall? It takes more than great companies to build a fortune for the future. Learn the basic financial habits of millionaires next door and get focused stock ideas in our free report, "3 Stocks That Will Help You Retire Rich." Click here for instant access to this free report.

Add Axiall to My Watchlist.

Popular Posts: 3 Best ETFs to Own Until You Die5 Safe Dividend Stocks Yielding North of 7%Auto Parts: You Must Own One Stock in This Sector Recent Posts: Auto Parts: You Must Own One Stock in This Sector 5 Safe Dividend Stocks Yielding North of 7% Time to Tune in to AMC Networks View All Posts

Popular Posts: 3 Best ETFs to Own Until You Die5 Safe Dividend Stocks Yielding North of 7%Auto Parts: You Must Own One Stock in This Sector Recent Posts: Auto Parts: You Must Own One Stock in This Sector 5 Safe Dividend Stocks Yielding North of 7% Time to Tune in to AMC Networks View All Posts